Finance is forever changing, and the advancements in technology have led to a new wave of app-only banks being introduced into the market.

These snazzy, functional banks have had their work cut out tackling their more established, older brothers.

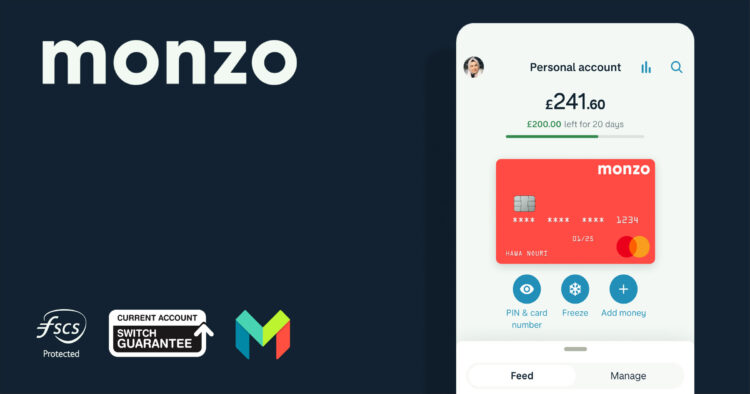

Perhaps none have been more successful in taking on the ‘big 4’ than Monzo.

But is it so good that it’s worth switching over to this company?

All shall be answered in this full comprehensive Monzo review.

What Is Monzo?

When it comes to the finance industry, the origins of many companies are somewhat boring and uninspiring.

The same can’t be said for the new kid on the block, Monzo or as it was once known, Mondo.

Its 4 founders were prior workers at Starling Bank, arguably Monzo’s biggest competitor today in the ‘app only’ sector.

Funding was secured through a crowdfunding session with the platform crowdcube, which would go on to break a few records.

At the time, Monzo would become the fastest crowd-funded project in history, raising no less than 1 million pounds in 96 seconds.

Monzo originally started as a prepaid debit card and a mobile app.

However, in April of 2017, Monzo’s banking licensing would be granted, meaning you could open a deposit account with them.

For 3 months, Monzo would report over 250 million pounds was spent through their prepaid cards.

Extremely impressive for a startup, so much so that it would win the ‘best start-up tech company to work for’ award from Linkedin Uk (2018).

Around the same time, Monzo would look to secure more funds from Crowdcube, the platform that had helped get them going.

Once again they would break another record for the largest ever crowdfunding round for a fintech company ever, raising 20 million.

From this point onward Monzo has been consistently evolving to stay ahead of its competitors.

In terms of the company’s structure, Monzo brands itself as a clear and transparent bank for everyone by everyone.

So far it’s proved effective, amassing a community of over 4 million people.

Monzo even encourages users to give suggestions for features and to conduct app testing for them.

It sounds like the ideal bank so far doesn’t it?

How Does Monzo Work?

Monzo has cut ties with the traditional banking system, in terms of possessing psychical branches.

What this means is it’s essentially an online bank but shares all the necessary qualities of the ‘big banks’.

Monzo currently offers business accounts, joint bank accounts and of course, personal bank accounts.

Just like better-known banks, you can set up direct debits, make contactless payments, and withdraw and transfer money.

Much like Monese and Revolut, Monzo differentiates itself from traditional banks by allowing users to manage their money.

As a result, this gives you more freedom and control over your finances.

Monzo’s Features

- Spending notification– Recieve real-time information regarding your spending

- Freeze your card– If you ever lose your card or have misplaced it, you can simply log into the app and freeze your card

- Monzo overseas– Free overseas transaction fees + first ATM up to 200 euros is free (refreshed every 30 days)

- Get paid early– Removes the clearing period of a BACS payment from your employer allowing you to get paid a few days early

- Salary sorter- Allocate your wage to different categories such as bills, savings etc.

- Budgets– Set budgets to prevent overspending

- Spending reports– Get a breakdown of your spending analytics and habits to help improve your money management

- Chat support– Get on-demand help via a chatbot or request to speak to a human

- Transaction history– Track your spending history so you can stay on top of your ingoings/outgoings

Is Monzo Safe?

Monzo is fully regulated by the FCA, meaning it has the same securities levels as most other banks.

The goals of the FCA are:

- To safeguard customers

- Enhance the integrity of the UK financial system

- Promote healthy competition to improve services for the public

If Monzo for some reason goes bankrupt, any money you have in your account (up to 85,000) is protected by the financial services compensation scheme.

Not only that but joint accounts are protected for up to 170,000 giving you security if you choose to open up an account.

It’s safe to say that Monzo is secure and protected.

FAQS

What is a Monzo card?

A Monzo card is a financial tool issued by Monzo, a digital bank based in the UK.

What type of card is Monzo?

Monzo is a debit card that gives access to various banking services through the Monzo mobile app.

Is Monzo closing down in 2023?

Many people are asking: Is Monzo closing down? The answer is no. Although Monzo has seen a decrease in valuation from £2 billion to around £1.25 billion as a result of the pandemic, they have no intention of closing.

Who Owns Monzo?

Monzo’s ownership structure is not in the public domain as it’s a private company.

Can You Use Monzo Abroad?

Yes, you can use Monzo abroad.

How Do You Get A Monzo Card?

You can get a Monzo card by downloading the app- a step by step guide can be found above.

How Do You Activate a Monzo Card?

Activating your Monzo card is done via the app.

A full breakdown of the process can be found above.

How do Monzo and HyperJar meet different financial needs?

Monzo is a full-service digital bank, while HyperJar card is tailored for purpose-driven money management.

Monzo Review 2023

So far in this Monzo review, I have only included my personal experience with the bank.

To provide a more well-rounded and complete Monzo review, I like to include customers’ opinions/experiences.

According to Trustpilot, Monzo has an overall rating of excellent from over 22,000 reviews.

80% of the Monzo review rated the company 5 stars whilst 11% rated them at 1.

Positive Monzo review included things like:

- Straightforward and insightful

- Great banking experience

- Excellent service

Negative Monzo reviews mention things such as:

- Offers nothing for loyalty

- Account closures

- Don’t believe the hype

Pros Of Monzo

- Customer support

- Clear interface

- Lots of great features

- Safe and secure

- Always evolving/innovating

- Strong branding/marketing

Cons Of Monzo

- Psychical branches would be useful for some customers

- Needs more refinement options when checking transaction history

- Account freezing and closures

- Users have had issues regarding fraudulent claims

Final Thoughts On This Monzo Review

Monzo prioritises continuous improvement, responsive customer support, and addressing user concerns. Users are encouraged to actively engage, ask questions, and contribute to the ongoing dialogue, creating a banking environment that aligns with their needs.

Monzo is known for its innovative and user-friendly approach. Besides, it also outlines the challenges in a changing market. You should consider that the features and offerings of any financial services can change, and you need to check the latest information and most up-to-date details to improve financial literacy.

Whether or not you open an account with Monzo seems to come down to this:

Are you happy to take a risk, albeit small, that you could encounter difficulties regarding account closure or freezing?

If you are, then 9/10 you are going to enjoy the features and overall style of the ‘new school’ bank that is Monzo.

However, a lot of people, particularly when it comes to finances (rightly so), are not happy to take this risk no matter how small.

It’s a shame to see that a great brand can be tarnished by what seems to be a handful of issues.

That is, unfortunately, the nature of the market Monzo is in.

I hope you found this Monzo review useful, I always try to be as transparent and unbiased as possible to bring you the best reviews.

With Monzo business account review, I have done many similar software review posts on Monzo’s competitors such as:

As always be sure to leave a comment if you have any questions or if you think anything was missing from this Monzo review.