Chip Review: The Best App for Saving in 2024?

Looking to boost your savings in 2024? With so many financial management apps flooding the market, finding the right one can be daunting. Not to mention the fact that saving money can often be difficult and, in some cases, a lengthy process. Particularly when that voice emerges from the back of your head and convinces you to buy something you don’t need.

But what if I told you there is an app out there that automates your savings effortlessly and emotionlessly and does so in a data-driven way? You would think I was smoking something until I told you it’s made possible by utilising artificial intelligence (AI).

Let’s take a look at what sets Chip apart from the rest and whether Chip truly earns the title of the best app for saving in 2024.

Chip at a Glance

|

What is Chip?

Chip is an award-winning wealth app that was founded in 2016 with the goal of automating and ultimately simplifying money management, particularly when it comes to saving.

Some of Chip’s most notable awards include:

- Apple’s App of the Day

- British Bank Awards – Best Personal Finance App

- 11FS Best Onboarding

- People’s Choice: Savings Provider.

Much like Plum, Chip uses AI to help you save and invest all in one place. By leaving your finances in the hands of AI, you also remove the emotional component of money management. No need for that persuasive voice in your head now!

How does Chip work?

Chip’s AI-powered savings account redefines how you manage your finances. By seamlessly linking to your existing bank account and analyzing your transactions every couple of days, Chip intelligently determines how much you can comfortably save based on your recent spending patterns.

These funds are then automatically transferred to Chip, where they can be applied towards your financial goals, withdrawn when needed, or even employed to decrease borrowing.

It sounds like a great financial partner so far, doesn’t it?

Chip’s features

Perhaps the most interesting part of this Chip review is the features the app provides. When you are in a competitive space like personal finance, you need to separate yourself from the rest. You’ll soon see for yourself that Chip has given it a good go.

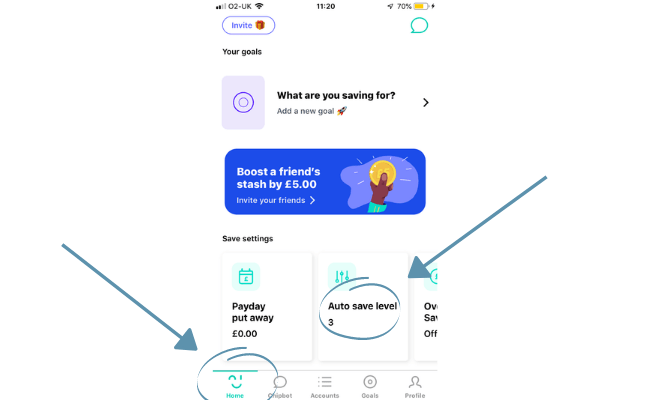

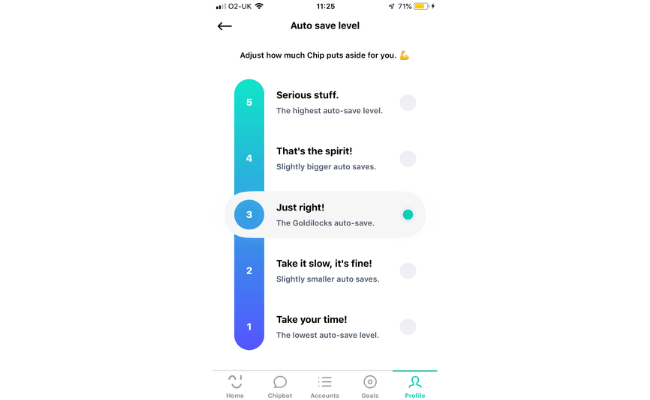

Automatic saving

The foundation of Chip, as we discussed earlier on, is automatic saving. It’s not hard to see that having a tailor-made, automated saving plan helps you save. The rate at which you save is entirely up to you and can be controlled via the savings settings.

Click on ‘autosave level’ and from here you can choose the number that best suits you at that current moment in time.

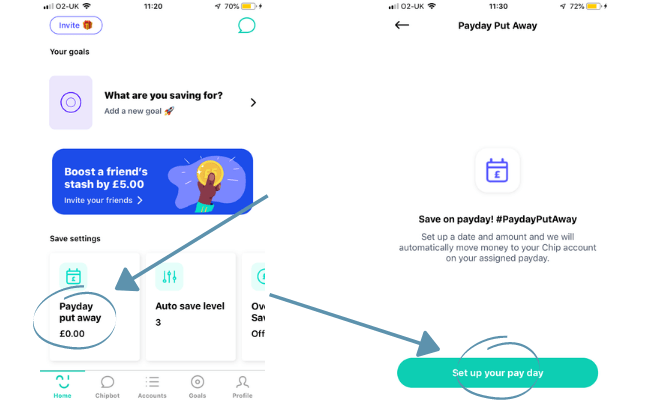

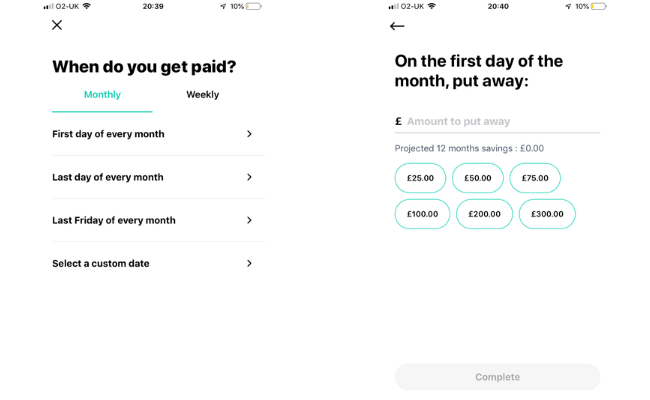

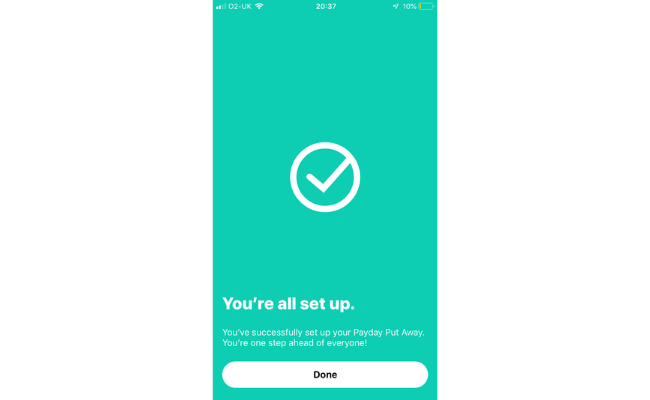

Payday

This feature is there to help you manage your payday loans. Chip then automatically calculates the repayment date and notifies you when the repayment is due. You can set up a date and amount in which Chip can automatically move money into your account. Simply head over to the saving settings and click ‘payday put away’.

From here you can input your payday whether that be monthly or weekly and set the amount.

After you press ‘complete’ guess what?

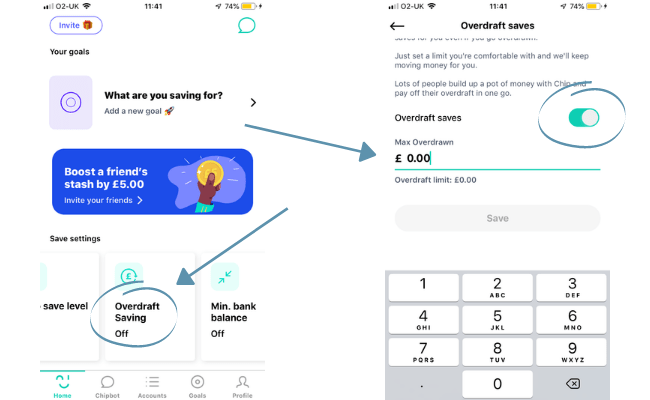

Overdraft

If you ever need to save up to pay your overdraft, you can do it with Chip. Just set a limit you are comfortable with Chip moving for you, and they’ll store it until you need it. This feature helps people pay off their overdraft in one payment and avoid the unnecessary fees associated with overdrafts.

To activate this, just go down to the saving settings and click ‘overdraft saves’.

Move the slider, set the amount, and you’ll now have overdraft saving active.

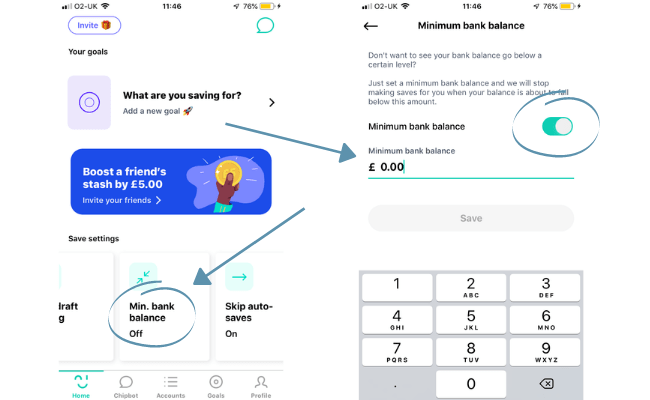

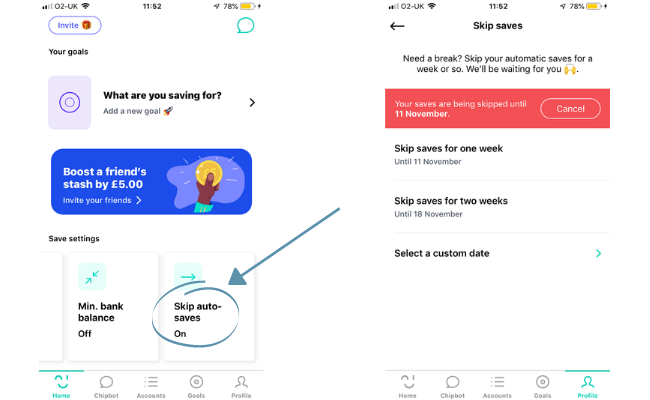

Bank balance

Chip gives you more control over your savings by utilising the ‘minimum bank balance’ feature.

If you don’t want to see your account go below a certain figure, just input an amount, and Chip will disable saving.

This will only happen if you go below the balance you set; otherwise, it will continue to automatically save.

To turn this feature on, move down to saving settings, press ‘min. bank balance’, and set an amount.

Skip auto

If, for whatever reason, you want to pause automatic saving, Chip allows you to do this quickly and easily.

Set the period of time for which you would like Chip to pause saving, whether that be a week, month, or other.

After confirming, you won’t have to worry about money being taken from your account in a period where you may need it all.

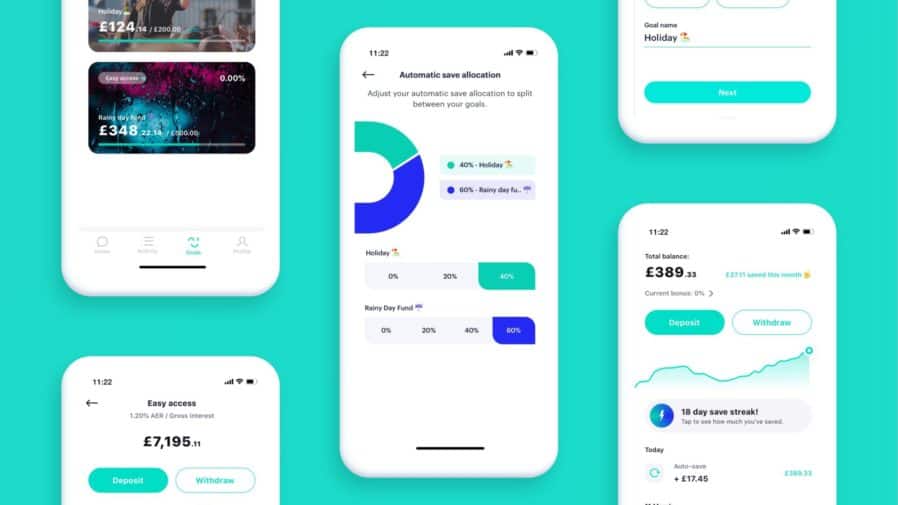

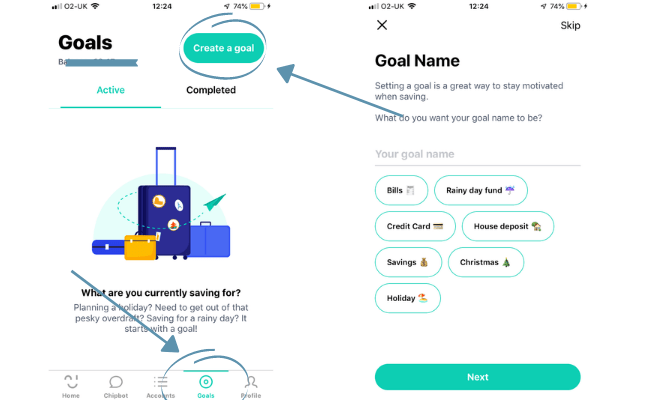

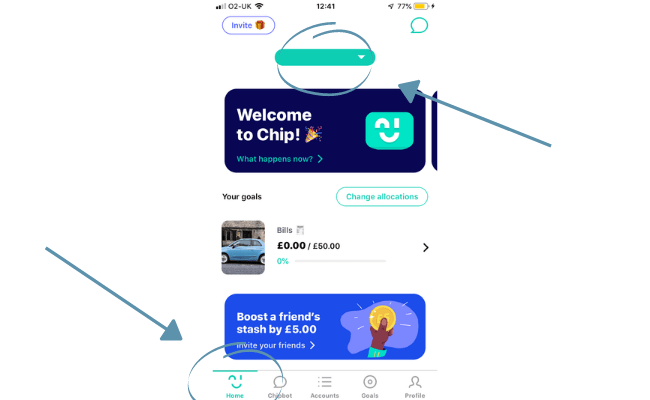

Savings goals

Setting yourself savings goals for events such as holidays or even rainy days is a great way to reward yourself.

Not only are you rewarding yourself, but you’re actually incentivising saving, which can only be good!

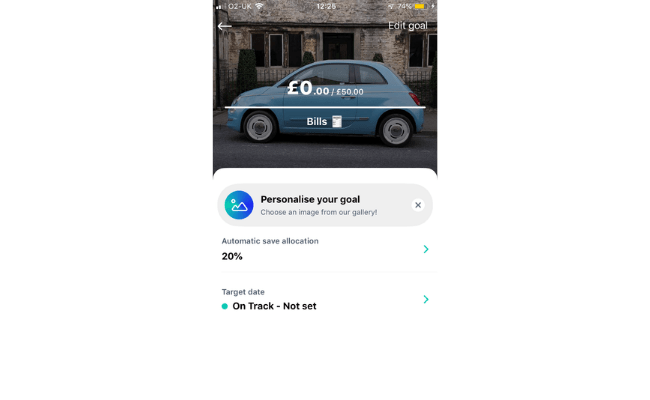

Similar to Starling Bank‘s feature ‘spaces’, users can set a target sum to achieve by a certain date.

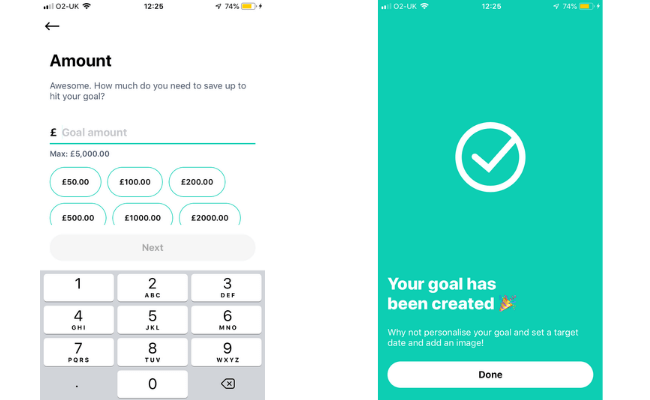

To do so, move along to the goals section, click ‘create a goal’, and name it.

Choose an amount and you’ll then be greeted with a notification to say your goal was created.

There are further customisation options such as a display image for your goal and automatic saving percentage.

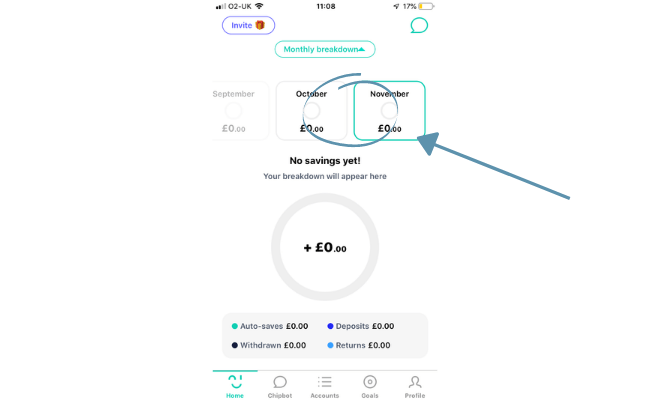

Monthly breakdown

It’s always useful to know the ins and outgoings of your account, a sentiment obviously shared by Chip too.

Your money will fall into one of these four categories:

- Auto-saves

- Deposits

- Withdrawals

- Returns.

The report can be accessed by clicking the green arrow underneath your balance.

You’ll then see a clear, visual display of what you’ve been doing with your money (including prior months).

Referral programme

A great way to promote your company is to have a referral program where users can share their links with friends and family to join.

If someone successfully signs up through your link, they receive a reward.

If you successfully refer a friend to Chip, they’ll boost the interest rate on your Chip Instant Access Account with 0.25% AER for 90 days (plus your friend gets a boost too).

To refer someone, click the invite button in the top left-hand corner of the home screen.

Open your contact book and you can start referring from there!

Chip’s savings accounts

Chip has three savings accounts offering award-winning wealth-building tools, competitive rates, and monthly prizes up for grabs. Here’s a quick rundown of each savings account and its main features:

Prize savings account

Chip incentivizes saving by offering you the chance to win cash prizes through regular prize drawings. Instead of earning traditional interest on your savings, you earn entries into prize drawings based on the amount you save.

The more money you save, the more chances you have to win your share of £75k monthly prizes. You can access your money anytime, and it’s FSCS protected.

Chip cash ISA

When interest rates were low, the Personal Savings Allowance (where the first £500 or £1,000 of interest was earned tax-free) covered most adults in the U.K.. But now, with the much higher interest rates on savings, many people are now earning above this tax-free threshold.

Enter the Chip Cash ISA.

This ISA lets you keep more of the interest you earn. If you deposit up to £20,000 per financial year, you pay no tax on the accrued interest. It’s all yours. Here are some more highlights:

- 5.10% AER

- Deposit and withdraw instantly

- Earn tax-free interest monthly

Chip instant access

This is Chip’s flagship savings account. It’s easy to access and designed to move with the market and reward you quickly, all in one savings app.

- 4.84% AER (variable tracker)

- Deposit and withdraw instantly

- Deposit up to £250,000

Is Chip safe?

The Financial Conduct Authority (FCA) now regulates Chip as an authorised payment institution. This is a big boost for the company, opening many doors for them.

The goals of the FCA are to:

- Safeguard customers

- Enhance the integrity of the U.K. financial system

- Promote healthy competition to improve public service.

This means your money is protected by a series of safeguards.

Chip is also proud of its 128-bit encryption software that protects data.

It should be noted that Chip is not protected by The Financial Services Compensation Scheme (FSCS).

The FSCS reimburses money to customers in the event of a company going bust but does not protect funds classed as ‘E-money’. Chip uses the E-money firm, Prepaid Financial Services, which creates what’s known as a ‘ring-fenced’ Barclays bank account.

(Note: Ring-fenced refers to a type of account in which the funds cannot be used for trading activities)

So, in short, your money is safe, and this recent FCA approval means that the next milestone is an FSCS-protected savings account via a partner bank.

Cost, fees, and membership plans

You can try out Chip with a 28-day free trial. Thereafter, you can choose between the Basic Plan which is absolutely free or the ChipX Plan at £5.99 every 28 days (paid monthly) or £65.05 paid annually (equivalent to £4.99 every 28 days).

Here’s a handy side-by-side comparison of the two plans:

|

Feature |

Basic | ChipX |

| General Investment Account | ✅ | ✅ |

| Access to competitive savings accounts | ✅ | ✅ |

| Stocks & Shares ISA | ❌ | ✅ |

| Autosaves | £0.45 per save | Unlimited |

| Recurring saves | £0.25 per save | Unlimited |

| 0% platform fees (Annual management charges still apply.) | ❌ | ✅ |

| Access to all our investment funds | ❌ | N/A |

| Chip Instant Access | ✅ | ✅ |

| FTSE 100 index fund | ✅ | ✅ |

| S&P 500 tech fund | ✅ | ✅ |

| Clean Energy fund | ❌ | ✅ |

| Crypto Companies fund | ❌ | ✅ |

| Emerging Markets fund | ❌ | ✅ |

| Physical Gold fund | ❌ | ✅ |

| Healthcare Innovation fund | ❌ | ✅ |

| Ethical fund | ❌ | N/A |

| Global Companies fund | ❌ | ✅ |

Chip reviews

According to Trustpilot, the company has an overall rating of 3.8 from over 1,500 Chip reviews (at the time of editing).

65% rate the company as excellent, while 22% rate them as bad.

Here’s a summary of the positive chip reviews:

- It actually helps you to save.

- Easy to use and set up Chip accounts.

- Convenient way to manage finances.

Negative Chip reviews tend to talk about these few things:

- Withdrawal times.

- Issues surrounding customer service and response times.

So, all in all, when looking at the Chip reviews collectively, the response to the app is largely a positive one.

Chip FAQs

Which is better: Chip or Plum?

Chip and Plum offer very similar sets of services overall, both in terms of features and subscription models.

Each company has its appeals over one another, but the general consensus is that you get more from Plum.

Is Chip a good investment?

Chip has a nice array of investment funds available for you to choose from, depending on your risk tolerance.

So, if you are looking for a ‘hands-off’ approach to investing for a respectable management fee, Chip could be a good option for you.

Just remember that whenever you invest, your capital is at risk.

How do I stop Chip from taking my money?

If you are a part of a paid monthly subscription plan with Chip, simply downgrade to ChipLite—it’s 100% free.

The verdict: Is Chip the best saving app in 2024?

Now, this Chip review is drawing to a close. Here’s my take on the app, taking into account my experience as well as the experience of others.

The app was created with its main purpose of helping people save.

The overwhelming majority of users, including myself, think it does that.

By automating the process with AI, it allows people to get on with their lives while Chip is saving for them in the background.

So, in that respect, yes, the company is a success and has achieved what it set out to do.

However, money management is a competitive space, and there’s a wide range of other apps and even banks that are great in this field.

Chip, in comparison to the competition, could be considered rather simple because it remains true to saving.

Revolut, for example, has many saving capabilities (budgeting, savings goals) but also has the functionality of a bank, allowing investing, etc.

So, if you are happy with an app that only helps you save, then Chip is a great option. If you are looking for a bit more than that, there are plenty more options out there. many of which I have reviewed.

Related Articles:

If you enjoyed this Chip review, don’t forget to leave a comment and check out The Money Equation on our social media pages and read more of our reviews.