Up until recently, at least in England, Triodos has gone somewhat unnoticed by the public.

This is perhaps a testament to how hard it is to stand out today in a financial market that is so competitive. I don’t know why, but everyone seems to want to look after your money for some reason or another!

Jokes aside, Triodos has ignored the threat posed by its older counterparts like Barclays to do its own thing, which is certainly admirable.

Last year, they came first in the Best British Bank awards for ‘best investment provider’ and ‘best ethical financial provider’.

So just how good is this small challenger bank, and is it worth opening an account with them? Let’s find out in this comprehensive Triodos bank review.

Triodos at a Glance

|

What is Triodos Bank?

You can trace Triodos Bank’s origins back to the Netherlands, where it became successful for its unique mission in the banking industry.

According to Triodos, their mission is to ‘create a society that protects and promotes quality of life and human dignity for all’.

Triodos achieves this by providing ethical financial products to individuals and businesses, using money in such a way that it benefits the environment.

You could see Triodos as a ‘green bank’ that focuses on sustainability and ethical practice.

The challenger bank also has some attractive values, emphasizing their value for prospective customers.

Excellence

High-quality services and products, striving to be one of the best in the banking sector.

Transparency

Triodos is crystal clear about where your money goes.

Sustainability

Triodos only finances companies that focus on culture and the environment.

Entrepreneurship

Always developing innovative ways to finance sustainable companies, entrepreneurs, and initiatives.

How does Triodos Bank work?

Triodos is what’s known as an online bank because, you guessed it, they have no physical branches. This is common for alternative banks as they believe in evolving away from the traditional banking style.

By providing a modern approach to finance, at least in theory, they gain some of the markets that more ‘old school’ banks neglect.

According to Triodos, they have over 744,000 customers using their cards and app – which is nothing to turn your nose up at.

Just like any other bank, Triodos offers business, joint, charity, and/or personal accounts for users. You’ll receive your card through the post when you complete the signup process (more on this next).

Once it arrives, you can activate it via the Triodos Bank app.

This will then allow you to set up direct debits, Apple Pay, standing orders, etc.

We’ll touch upon some features later on in this Triodos Bank review, but for now, we’ll have a quick look at the signup process.

Setting up a Triodos Bank account

(Note: If you have already signed up, skip this portion of the Triodos Bank review.)

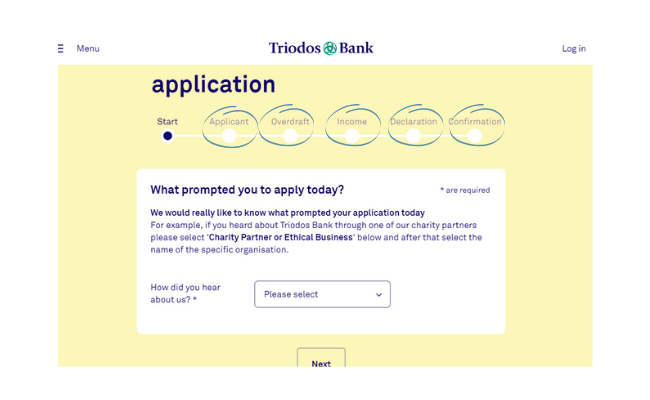

The signup process takes place purely online and can be done via the Triodos Bank website.

This example will show you how to set up a personal account—requirements vary with account types.

Before we get started, here are a few criteria you need to meet:

- You must be over 18 and a U.K. resident.

- You have no county court judgments against you.

- You have not filed for bankruptcy, a debt relief order, or an individual voluntary arrangement in the last five years.

Here are a few things you’ll need at hand when setting up a Triodos Bank account:

- Your previous address (if you have moved in the last three years)

- Details of your income and expenditure

- Your national insurance number or tax identification number.

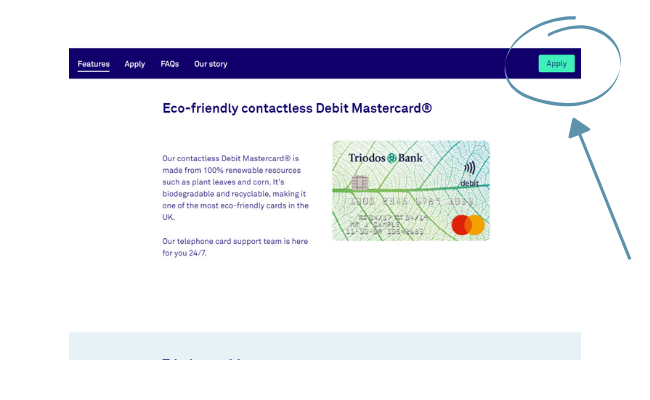

Head over to Triodos, click on the menu and press ‘I am an individual’.

From here, you can click on the ‘personal account’ option. Read through the account features, and as you scroll down, you’ll see the option to apply will appear.

Now, you can start your application and fill out all the required details.

After you have completed this, your details will be verified, and a card will be sent.

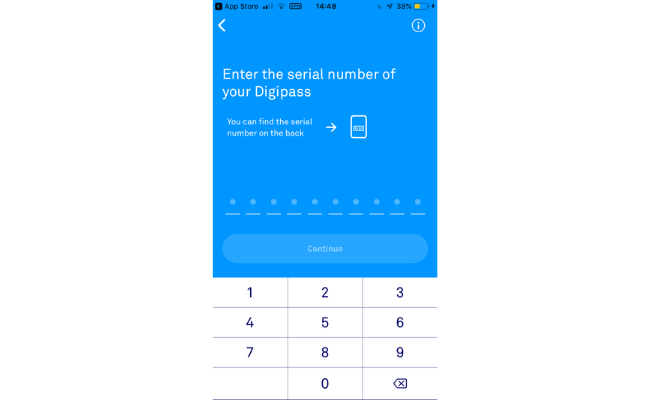

Now, all you need is the app! Depending on your device type, it’s available on either the Apple AppStore or Google Playstore.

Next, you can connect your app to your account by filling in your Digipass.

From here, you’ll then be able to access the app’s main interface, allowing you to use all the features I talk about later on in this Triodos Bank review.

Is Triodos Bank safe?

This is an important question to answer, particularly in light of the U.K. leaving the EU.

As I mentioned earlier, Triodos is a Dutch bank that adheres to laws and regulations that differ from U.K. banks.

As a result of Brexit, Triodos decided to create a new subsidiary company in the U.K., owned entirely by Triodos NV.

By doing this, Triodos became eligible for the U.K.’s financial compensation scheme, as the company has to abide by the U.K.’s rules and regulations.

Triodos used to be covered by a Dutch compensation scheme that protects personal accounts up to €100,000 (£83,500). Joint accounts would have also been protected up to €200,000.

Now, they are covered by the U.K. Financial Services Compensation Scheme (FSCS), personal accounts are protected up to £85,000, and joint accounts are protected up to £170,000.

Although the difference seems trivial on paper, you’d have to factor in exchange rates and communication with Dutch authorities.

So this was definitely a smart move on their part, particularly since prior criticisms of Triodos Bank revolved around whether or not they were fully committed to their U.K. division.

I like to think this action has silenced such critics.

So, in short, your money will be safe and secure with Triodos.

Interest rates and fees

Triodos make it perfectly clear and do not try to hide the fact that they charge £3 a month for a personal account with them.

Here’s Triodos’ take on charging a monthly fee: “Typically, banks offer ‘free’ bank accounts with hidden costs and high overdraft charges—often with financially vulnerable customers footing the bills.”

Certainly, a fair point that very much aligns with their values of being a transparent bank.

(Note: Triodos says this fee goes towards the cost of running your current account).

In terms of savings and ISAs accounts, Triodos provides six different accounts, two for children. Let’s have a look at them.

| Everydays Savings | Upto 0.30% Gross AER |

|---|---|

| Regular savings | Upto 1.26% Gross AER Monthly deposits from £25 to £500 |

| Fixed Rate Bond | Upto 0.40% Gross AER |

| Variable Rate Cash ISAs | Upto 0.40% Gross AER Tax free |

| Right Start Saver | 0.55% Gross AER |

| Junior Cash ISA | 1.50% Tax Free AER |

When it comes to overdrafts, Triodos has a very simple model. Here’s an overview:

- Maximum Overdraft Amount: £2,000.

- Flat Interest Rate: 18% EAR variable for each day you use it.

- Example: A £2,000 overdraft (based on 18% EAR variable) will charge you at most £0.91 a day or £30.58 a month.

Triodos mobile app

Like most banks today, Triodos has a full app in which you can do a whole host of things. After you open an account, you can simply link your account to the app by entering a DIGI code. Here’s a quick look at what you can do via the app:

- Check your balance and recent transactions.

- Discover inspiring lenders near you.

- Make payments to new and existing payees.

- See all of your accounts in one place.

- Log in using touch or face ID.

These are some handy features to have in your pocket.

Triodos Bank reviews

On Trustpilot, Triodos is rated as average from over 520 reviews. 58% of reviews rate them as excellent, while 22% rate them as bad.

Positive Triodos Bank reviews include things like intuitive UX, ethical banking, and ease of getting set up.

Negative Triodos reviews touch on things like slow payment times, card declines, and customer support issues.

Triodos Bank FAQs

Is Triodos Bank FSCS protected?

Yes, Triodos Bank is FSCS protected.

Who owns Triodos Bank U.K.?

Triodos Bank U.K. is owned by Triodos Bank N.V., a Dutch company

How ethical is Triodos Bank?

Triodos is considered one of the most ethical banks in the U.K.

Do I need a smartphone to bank with Triodos?

To utilise Triodos Bank’s app, you will need a smartphone. However, you can access your account via the Triodos Bank website.

Conclusion of this Triodos Bank review

Triodos’ story and values are definitely a breath of fresh air in the banking industry. As a challenger bank, it’s Triodos’ job to attract a small part of the market that wants an alternative to the ‘big four’.

However, there seems to be a trade-off point between having a smaller bank with a more intimate experience and a bigger bank with a more refined system/service.

I suppose the question to ask yourself is whether or not you’re willing to accept a slightly lesser quality service (in comparison to the big four) for an ethical bank with good intentions.

If you are, then, by all means, try Triodos. You can’t come second in the Best Bank Awards and win the Best Customer Support award without really giving it your all as an organisation.

If you aren’t impressed by what you’ve seen, then you’ll likely be better suited to a bigger, more established bank. I hope you found this Triodos Bank review helpful. If you are looking for a different bank, particularly a challenger, check out these posts:

If you are looking for useful finance software articles, take a look at these reviews:

As always be sure to comment on this Triodos Bank review if you enjoyed it or think I missed anything.