Is Revolut the Best International Option in 2024?

Do you know what the U.K.’s second-largest fintech startup is?

I must admit I didn’t either, but according to data from Beauhurst, it’s the company we are reviewing today. A company that managed to raise a grand sum of 1.27 billion. It makes sense then that Revolut is a preferred choice for many.

So what does that mean for you and me, the consumers? Hopefully, a refined financial product that brings real value to its users.

This review will delve into the core aspects of Revolut, focusing on security, customer service, user interface, account types, and fees to provide a well-rounded understanding of its offerings.

Revolut at a Glance

|

What is Revolut?

Launched in July 2015 by Nikolay Storonsky and Vlad Yatsenko, Revolut was designed to simplify cross-border spending and currency exchange; to allow travellers to swap between currencies cheaply.

Over time, it has become more of a digital payment system that provides lots of financial tools to help users improve money management.

Today, Revolut can be found trying to “build a borderless, customer-centric platform which feels personal to everyone and will serve as their trusted companion to manage and grow their money.”

How does Revolut work?

As I mentioned earlier, Revolut is a solely online bank, meaning you can do all the essentials and then some via the app.

Just like “normal” banks, Revolut offers personal and business accounts for its users.

(Note: Instead of joint accounts, Revolut offers a group vault feature)

You’ll be able to set up direct debits, standing orders, and so on through the Revolut app.

Besides the normal features of traditional banks, Revolut has many money management features you can take advantage of.

By providing such features, users have more control over their finances in the hopes it will encourage better money management.

Revolut’s features

(Note: All of these features are standard and do not include the added perks from upgraded plans)

This section on features is likely to be the most interesting part of this Revolut review simply because it provides so many.

Let’s take a look at each one in some detail.

Overseas

Having started out as a card designed to help achieve good exchange rates when travelling abroad, you would assume Revolut would excel here.

If you did, you’d be 100% right because Revolut charges no fees for spending abroad.

It should be noted, however, that limits do apply.

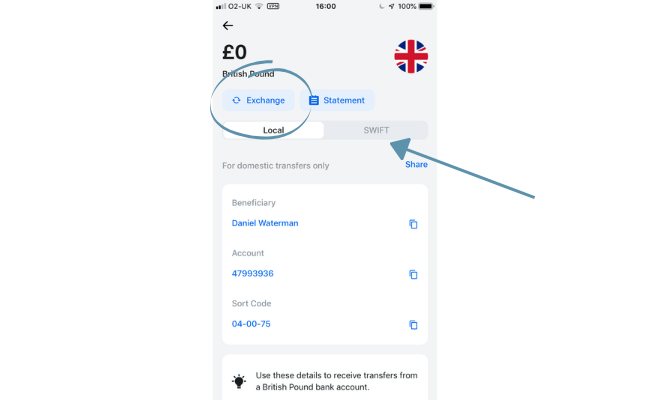

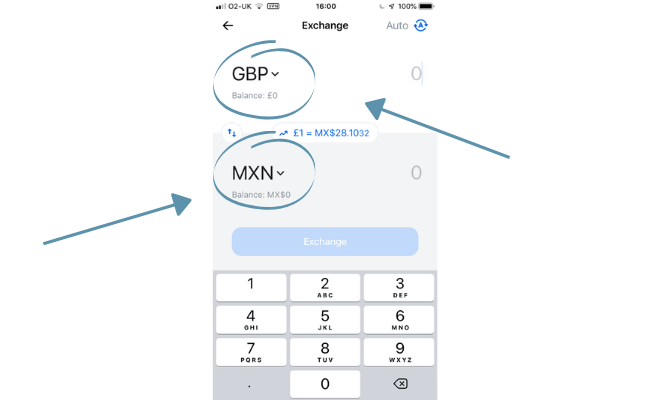

Another handy feature that is accessible through the app while the topic of being overseas is its currency exchange feature.

You can exchange 30+ currencies in-app using an up-to-date exchange rate and pay in 50+ currencies with your Revolut card (as at the time of writing).

To do this, all you need to do is head over to your accounts tab and click the account you want to adjust.

Press exchange.

Then you can choose what currencies you want to exchange using the markers.

There you have it: simple and useful.

Round-up

Every time you make a card transaction with Revolut, they can round up your purchase to the nearest whole number.

By selecting this feature, you can then place that money in one of your vaults/saving goals. You have the option to accelerate this if you choose to, meaning the change can be multiplied by a factor of 2, for example.

Round-up is also adjusted for each currency as the value of each unit varies.

This is an idea that was given to Revolut by a user.

So not only did they listen, but they implemented it, which is nice to see.

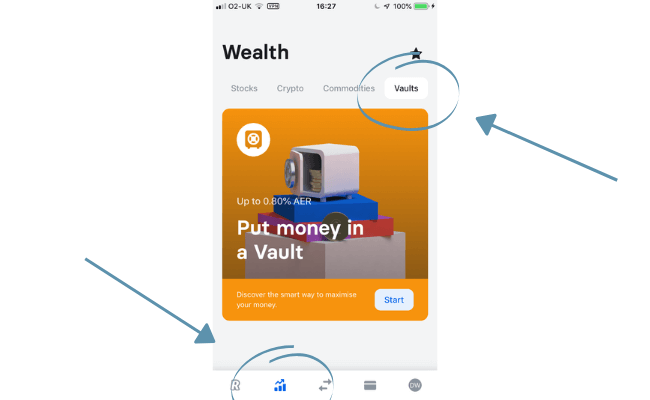

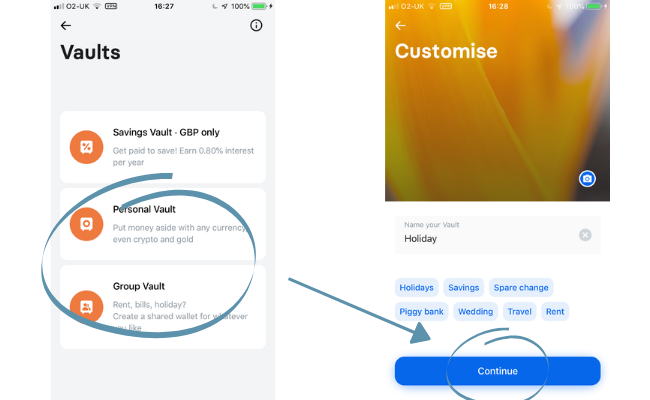

To activate this feature, head over to ‘vaults’.

Select what type of vault you would like and label it.

(Note: Savings vault is only accessible to upgraded accounts)

After you select your goal, you’ll be taken to the section below where you can choose to activate the feature and to what degree.

This goal will then appear in the ‘vault’ section after completion.

Budgets

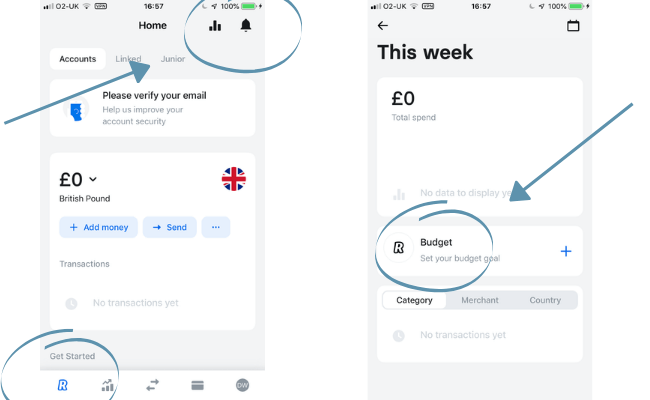

Budgeting is a very useful feature that we all need.

Whether we like budgeting or not, it’s important, and Revolut thinks so, too, as they have integrated a budgeting feature.

In theory, the more control you have over your finances, the better you’ll manage them.

To set up a budget, simply head over to the graph in the top right-hand corner, and you’ll then be presented with the budgeting function.

You can then set a budget for whatever you like.

There is also the option to categorise your budgets as shown below.

Budgeting made easy.

Transaction history

Although this is almost a compulsory feature in today’s day and age, it’s still worth noting.

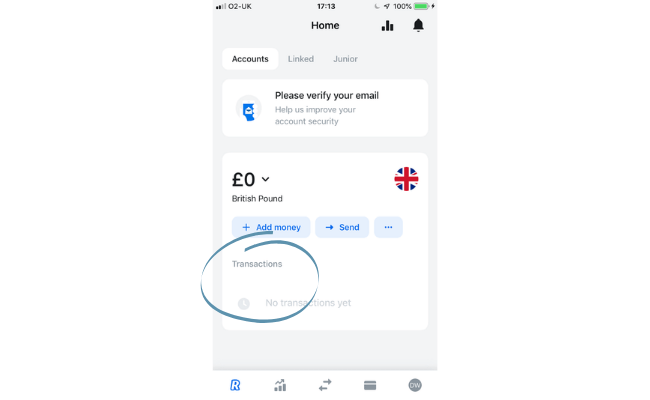

You can find a clear breakdown of your spending on your homepage, as shown below.

Further information about the transaction can be accessed by clicking on it.

Split bill

Splitting bills is a neat feature you can take advantage of with Revolut. You can settle payments with any of your contacts.

When you set up a split bill feature, the individual who owes you will be notified instantly.

In a few clicks, the payment can be sent to you.

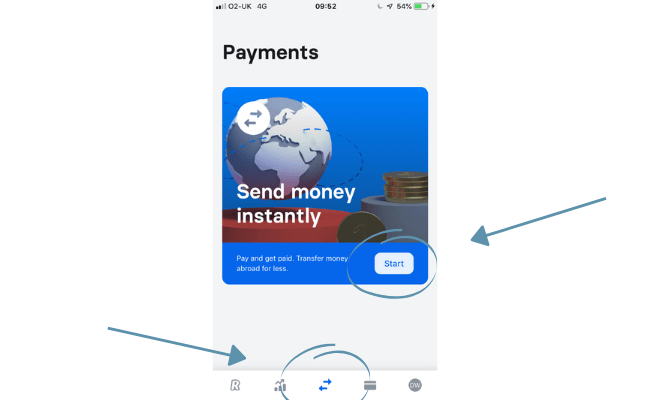

To set this up, all you need to do is head over to payments and click start.

(Note: When you first get started, you will have various slides on features that you can familiarise yourself with, including splitting bills)

Click ‘get started’.

Then, you can select from your contacts who owe you their share of the bill.

Investment vehicles

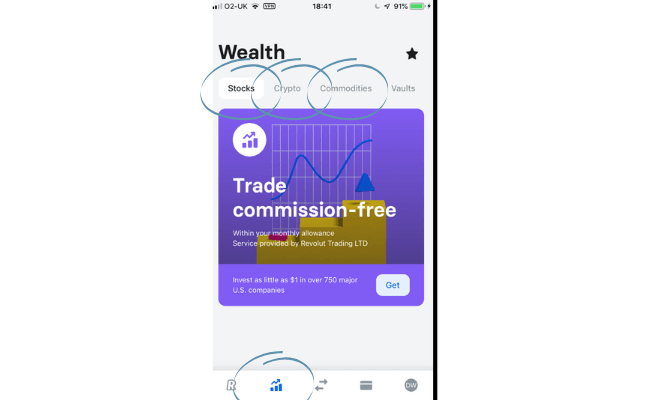

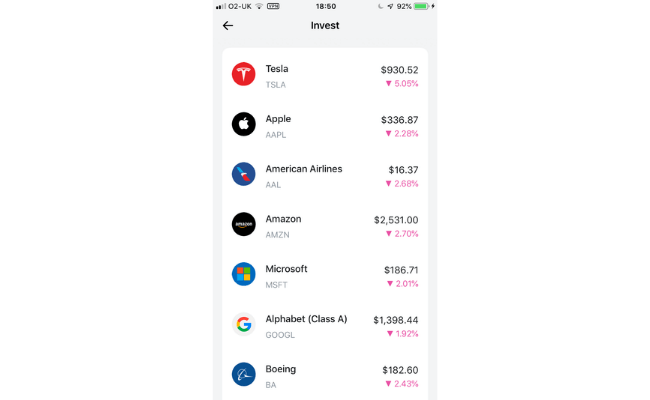

An extremely impressive feature that Revolut is able to facilitate within their app is investing not only in stocks but also in cryptocurrency and commodities.

To further sweeten the deal, all transactions on stocks are free from fees.

To access these investments, move over to the ‘wealth’ section.

As you can see from the image below, you have various investment vehicles to take advantage of.

To invest, simply click on what vehicle you want.

(Note: This example will be done using stocks)

Choose from the options listed through Revolut.

If you decide to invest, you’ll be asked to fill in your national insurance number as well as some other details.

After you have completed that, you can use it freely to invest in whatever you like.

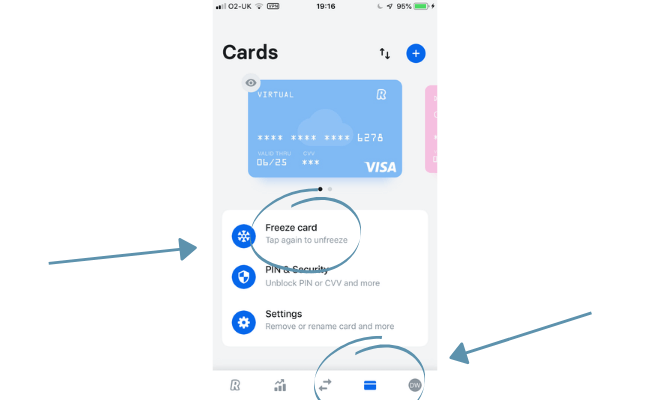

Freeze card

If you ever lose or misplace your card, you can simply freeze it via the app. This feature can save you time. There are no potentially long and boring phone calls with your providers this way.

Traditional banks should take note. All you need to do to freeze your card is head over to the card section and click ‘freeze card’.

To unfreeze your card, simply re-click it.

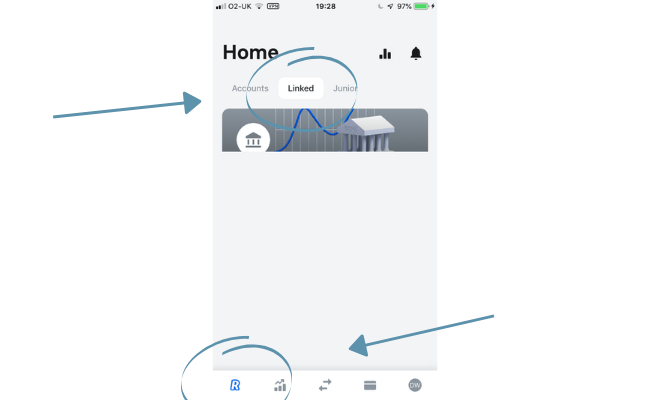

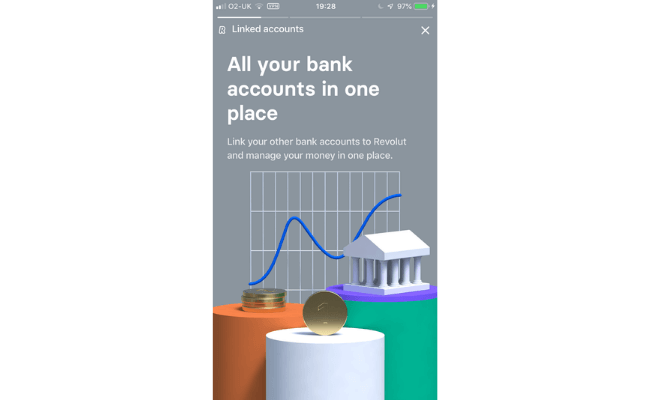

Link accounts

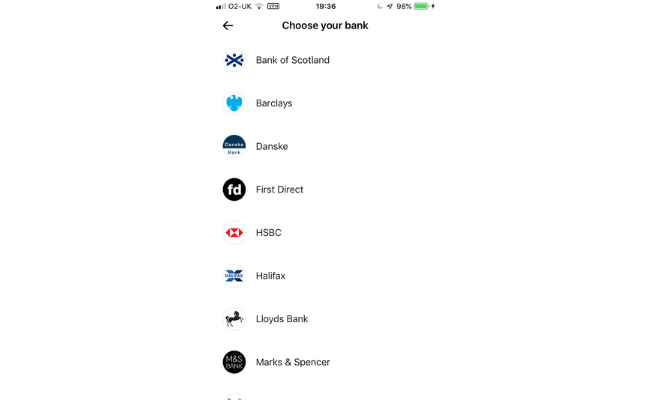

Revolut allows you to connect all of your other bank accounts so you have all your finances in one place, similar to Curve. As you can imagine, this is very useful.

To connect your accounts, head over to ‘home’ and click ‘linked’.

You’ll be taken to this screen.

After having a read you can connect the bank accounts you have with different providers.

Transfer abroad

Revolut proudly advertises that you can send money to over 30+ countries at the correct exchange rate. That’s pretty impressive, especially when you consider there are no ‘hidden fees and rubbish rates’, as Revolut puts it.

You can convert up to £1,000 for free, and upgrades to Premium, Metal or Ultra will allow you to send higher amounts.

To transfer, all you need to do is head over to the payments section.

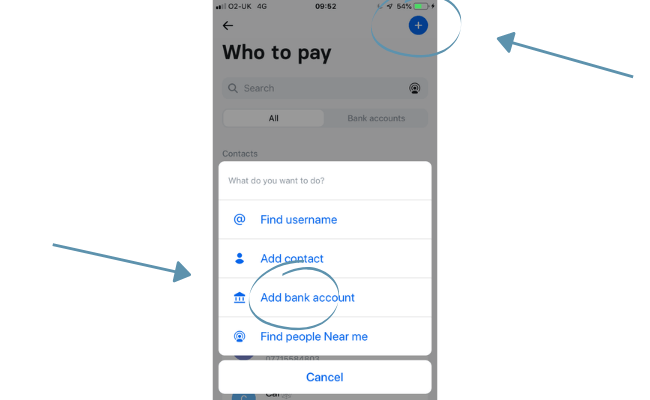

Then press the plus sign in the top right-hand corner a click ‘add bank account’.

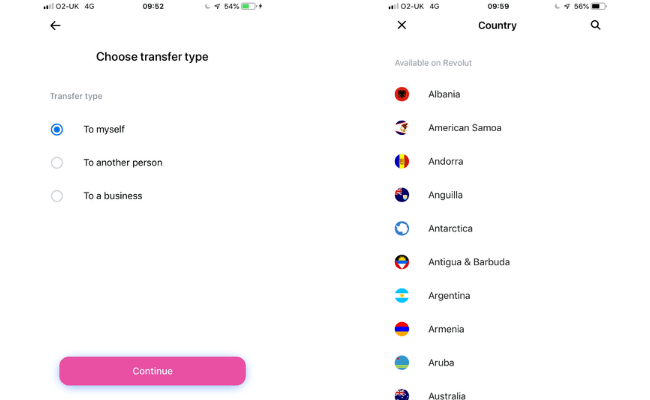

From here you just need to fill out some details including your recipient’s country.

After that, you’re good to go.

Spending notifications

You can get real-time information regarding your spending as soon as you make payments. That means you’ll be notified instantly. This can be particularly handy for users who have a joint and/or business account. It’s a simple feature but a convenient one to have.

Recurring payments

You can find information regarding your standing orders, direct debits, and subscriptions all in one place. By knowing in advance when money is coming out of your account, you can manage your finances around each payment. This information can be viewed on the home screen.

Accounts

You may have picked up earlier in this Revolut review that they offer different account versions: Standard, Plus, Premium, Metal and Ultra. Here’s a look at what each one provides in a side-by-side comparison:

| Perks | Standard | Premium | Metal |

|---|---|---|---|

| Card Customisation | standard card | Standard + 4 available colourways | Premium + metal card with extra 4 colourways |

| Cost | Free | £6.99/Month | £13.99/Month |

| Cashback | N/A | N/A | 0.1% in Europe, 1% outside |

| Free withdrawals | £200/Month | £400/Month | £600/Month |

| Overseas Medical Insurance | N/A | Included | Included |

| Free Spending Abroad | Included | Included | Included |

| Customer Support | Included | Included + Priority | Included + Priority |

| Global Delivery | N/A | Included | Included |

| Lounge Access | N/A | Included | Included |

| Flight Insurance | N/A | Included | Included |

| Junior Account | N/A | Upto 2 Children | Upto 5 Children |

Is Revolut safe?

Revolut is fully regulated by the FCA, meaning it has the same security levels as U.K. banks. They must adhere to strict regulations under the FCA to ensure great care is taken with our personal and financial details. The goals of the FCA are:

- To safeguard customers

- Enhance the integrity of the U.K. financial system

- To promote healthy competition to improve service for the public.

However, as I stated earlier, Revolut does not have a U.K. bank licence. What does that mean? The absence of a licence means that your money is not protected if, for any reason, Revolut was to go bust. Banks with a U.K. licence are backed by the Financial Services Compensation Scheme (FSCS), which protects accounts up to £85,000.

(Note: The only other difference is that Revolut cannot offer lending services)

However, a licence is hopefully on the horizon, as Revolut has filed for its U.K. licence. If there are any new developments, I’ll be sure to update this portion of the Revolut review.

Revolut also adds several layers of security to protect your data and finances, including:

- Encryption and Data Protection: Utilizing advanced encryption technologies, Revolut ensures that personal and financial information is securely stored and transmitted.

- Two-Factor Authentication (2FA): This adds an extra layer of security during login and when performing sensitive operations.

- Disposable Virtual Cards: These are designed for online shopping, providing a unique card number for each transaction to mitigate fraud risks.

So, to sum it all up, your money is safe and protected unless Revolut goes bankrupt, at least for the time being.

Revolut reviews

Revolut is rated 4.2 out of 5 on Trustpilot from over 149,000+ reviews.

75% of those Revolut reviews rate the company as excellent.

Positive reviews include:

- Easy, secure and efficient service

- Great features

- Good travel perks.

Negative reviews touch on things like:

- Customer service

- No longer fee-free.

Revolut FAQs

Can Revolut be trusted?

Revolut is authorised by the Financial Conduct Authority to uphold strict rules and regulations to protect customers.

What happens if Revolut goes under?

Revolut is not protected by the Financial Services Compensation Scheme, as it does not have a U.K. banking licence.

However, if Revolut were to go bust, you’d be able to claim your funds from your segregated account and will be prioritised over other creditors.

Who is the owner of Revolut?

The founder, Nik Storonky, owns around 20% of the company. The rest is held by private investors.

Is Revolut a normal bank?

Revolut does not have a full U.K. banking licence, making it an e-money institution rather than a bank. Although Revolut offers most services a bank can, it cannot offer lending services, nor are its users’ funds protected by the FSCS.

Final thoughts on Revolut

To wrap this Revolut review up, on the whole, I was very surprised.

Revolut was not on my radar until recently, and having studied the company and the services they provide, I can say I’m thoroughly impressed.

This card seems to be a must-have when you go abroad for the wide array of travelling perks they provide, staying in touch with their roots.

I also think the addition of virtual cards and investment vehicles within the app is very forward-thinking, which should be admired.

However, every business has its faults.

The main criticisms with Revolut seem to be related to their customer service and/or handling of users’ accounts (freezing and suspensions).

Lastly, if it had not been for the absence of their U.K. banking licence, Revolut would be in the conversation for the best challenger bank.

The decision is ultimately yours, but I hope this Revolut review has provided enough information for you to make a choice (whatever it may be).

If you are looking for reviews on alternatives to Revolut, check out some of the mobile app review articles I have recently created:

As always, be sure to leave a comment on this Revolut review if you enjoyed it or, equally, if you think I missed anything.