Monese Review: You Might Be Surprised

Monese, although relatively unknown compared to some of its competitors, arguably paved the way for the ‘modern-day’ bank. Therefore, in my view, this Monese review is long overdue.

Does being the first online bank to open in the UK make it the best, though? All will be answered in this article.

What Is Monese?

As mentioned earlier, Monese was the first mobile-only bank account to launch in the UK, opening its virtual doors to deposits in September 2015.

The whole concept of Monese was born when the founder, Norris Koppel, moved to the UK but found it hard to open a bank account. This was because he had no prior UK credit history or utility bill that could prove his address.

Out of this struggle came the philosophy of Monese: inclusive, instant, and on-demand.

In 2016, the company was awarded ‘Best Challenger Bank’ at the European Fintech Awards.

Following this achievement, they began to expand and develop their services, securing funding across Europe.

Fast forward to today, people from all over Europe can open a Monese account in just minutes without any hidden fees or restrictions.

This impressive story has led to the emergence of a new sector within the financial industry known as ‘challenger banks’.

How Does Monese Work?

Like most ‘new school’ banks, Monese has no physical branches. That means most actions can be done at the touch of a button.

Monese is essentially a bank in your pocket that anyone can sign up for within a few minutes (more on this later).

Just like traditional banks, Monese offers personal, joint, and/or business accounts.

As soon as you receive your card in the post, you can also start setting up direct debits, standing orders, etc., through the app.

All Monese cards have contactless functionality and can be synced with Apple Pay, allowing you to shop even without a physical card.

In addition to fulfilling the standard functions of a bank, Monese offers a wide range of money management features for you to take advantage of.

Monese’s Features

(Note: All of these features come standard, not requiring upgraded plans to access them)

This section will likely be the most interesting part of the Monese review.

Challengers to traditional banks typically try to level the playing field by offering convenient and useful tools.

As a result, you have greater control over your finances in general, which will help develop your management skills.

Let’s take a closer look at each one.

Multi-Currency Accounts

As you can see from the signup process, when creating an account, you can choose the currency you would like.

You are allowed to have an account for each currency, which is handy if you buy or sell abroad.

It can also serve as a good holiday account, as your money will already be in the correct currency without the need to change it at the post office.

Spending Notifications

You can get real-time information about your spending as soon as you make payments.

This means you’ll be notified instantly every time, which can be a particularly useful feature for individuals who have a business and/or joint account. It is a simple yet practical tool.

Track Expenditures

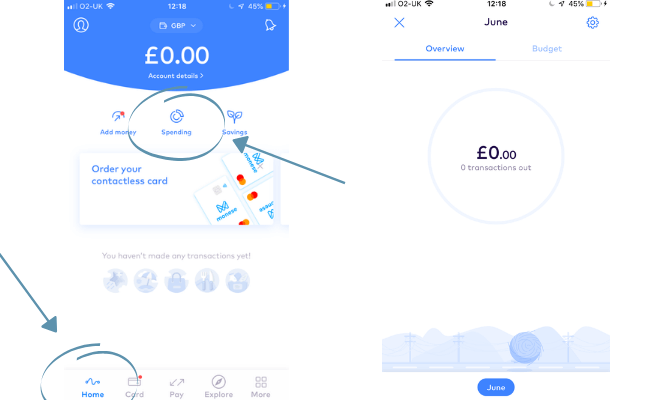

Monese has a dedicated section for tracking your outgoings.

Here, you’ll find a list of all your transactions throughout the month as well as your spending habits from previous months.

To access the reports, simply go to the ‘spending’ section on the homepage.

From here, you’ll have an overview of your spending data.

Set Budgets

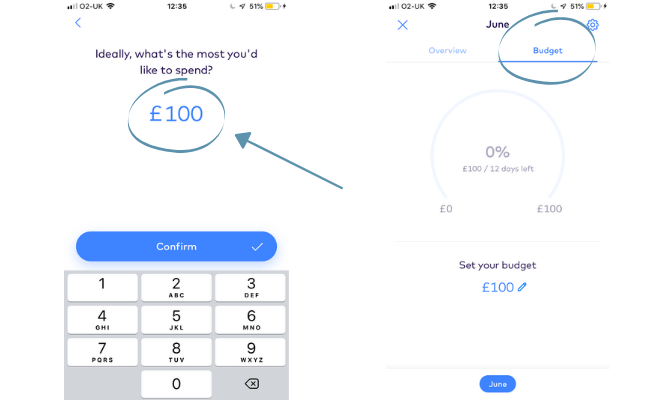

A trendy new feature that challenger banks are including in their apps is setting budgets.

Just like Monzo and Starling, Monese has a dedicated section for setting budgets.

This will serve as a friendly reminder to plan your expenses based on the budget you choose.

To set a budget, all you need to do is go to the ‘spending’ section once again.

Click on ‘budget’ and then select ‘set a budget’.

You can then set a limit, and you’re done.

From now on, you will find your budget under that section.

Abroad Transfers

Monese enables customers to convert money at an interbank rate, so you’ll pay the same wholesale rate as banks.

You can also have your money converted into 19 different currencies at the time of writing.

To send money abroad, all you need to do is head over to ‘pay’ and press ‘send money globally’.

Then you need to fill out some information regarding the recipient’s bank details, and you’re all done.

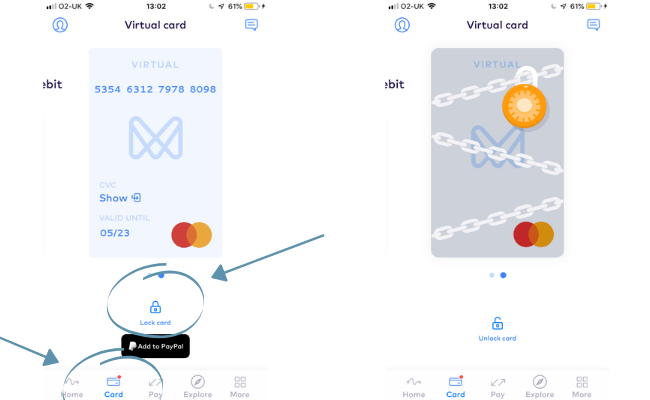

Lock Your Card

Locking your card, more commonly known as freezing your card, allows you to prevent transactions from taking place, making the card inoperable.

This feature can save you from having to make long and tedious phone calls to your provider, as you can easily do it with a simple push of a button.

To lock your card, simply navigate to the ‘Card’ section.

Once there, find the card you wish to freeze and click the ‘Lock’ button.

You’ll know when your card is locked because it will have the animation above it.

To unlock, simply click the same button. It’s as simple as that.

So if you ever lose or misplace your card, this feature will come in handy.

Monese Accounts

Earlier in this Monese review, you may have noticed that they offer three different account versions.

Here’s a look at what each one provides in a side-by-side comparison:

| Variation | Standard | Classic | Premium |

|---|---|---|---|

| Cost | Free | 4.16/month | 10.41/month |

| Withdrawals | £200 free 2% fee thereafter | £900 free 2% fee thereafter | Unlimited |

| Foreign Currency Transfers | Free to monese accounts 2% for other accounts (£2 feeminimum) | Free to monese accounts 0.5% for other accounts (£2 fee minimum) | Free for all accounts |

| Support | Included | Included | Included |

| Free Cash Top Up | N/A | £900 free 2% fee thereafter | Unlimited |

| Overseas Spending | £2,000/month 2% fee after | £9,000/monthly 2% fee after | Unlimited |

| Contactless | Included | Included | Included |

| Apple/Google Pay | Included | Included | Included |

| Direct Debits & Recurring payments | Included | Included | Included |

As you can see, both paid packages offer a substantial increase in perks.

However, there is a monthly recurring fee, and the standard card fulfils most people’s needs.

Ultimately, the decision is yours.

Hopefully, this side-by-side comparison has helped you decide which version would better suit you.

If you’re all up to date, we can move on.

Limits And Restrictions

Now you know what to expect from each account, it’s time to go over some restrictions and limits that apply.

Here’s a brief overview:

- Maximum account balance of £40,000

- Cash top-up via the post office £5 minimum – £500 maximum

- Cash top-up via PayPoint N/A minimum – £249 maximum

- Daily top-up via debit card £10 minimum – £500 maximum (up to 2 payments)

- Income faster & BACS payments (per transactions) N/A minimum – £40,000 maximum

- Card purchases (per transaction) minimum N/A – £4,000 maximum

- Daily cash withdrawals via ATM £300 maximum

- Outgoings faster & direct debit payments (per day) minimum N/A – £40,000 maximum

Is Monese Safe?

The case of Monese is very similar to that of Revolut in that they do not have a UK banking license. Technically, Monese is more of a digital payment system than a bank but still shares many of the same characteristics.

Here are the main differences resulting from not having a UK banking license:

- Not protected by the FSCS – If Monese was to go bankrupt, you would not be compensated for any losses in your account.

- Lending – Monese cannot provide lending services like overdrafts or loans.

What you will be glad to hear, however, is that Monese is regulated by the Financial Conduct Authority (FCA).

This means that Monese operates with the same level of security as banks, adhering to strict rules and regulations.

The goals of the FCA are:

- To protect customers

- To enhance the integrity of the UK financial system

- To promote healthy competition to improve service to the public.

In sum, your money is safe with the company unless it were to go bankrupt for any reason. I will be sure to update this portion of the review if any new developments occur (plans to apply for a license, etc.).

As with all of my reviews, I like to include other opinions and experiences with the company to arrive at a more well-rounded conclusion.

On Trustpilot, the company has received over 27,000 reviews.

68% of the Monese reviews rate them as excellent, while 17% rate them as bad.

Positive Monese reviews include statements such as:

- Quick and easy setup

- User-friendly navigation

- A great way to keep track of your money.

Negative Monese reviews mention issues such as:

- Account blockages

- Slow response times.

FAQS

Is Monese Safe and Legit?

Yes, Monese is regulated by the FCA and must adhere to strict rules and guidelines.

Can I Receive My Salary on Monese?

Yes, you can receive your salary on Monese.

What Happens If Monese Goes Bust?

Monese is not FSCS protected, meaning if they were to go bust, your funds will not be compensated.

Which Is Better, Monzo or Monese?

Monzo is FSCS protected, whereas Monese is not. That alone makes Monzo a safer and, therefore, better option.

Aside from that, Monzo provides more features overall and is considered one of the more popular challenger banks in the market today, despite having its problems.

Conclusion on this Monese Review

Now that this Monese review is drawing to a close, we have a strong basis to make a decision on how good it is as a whole.

Monese’s humble origins came about as a result of technical and demanding criteria for bank applications.

The company has developed a service that is quick, with an easy signup process for all members of the public across Europe.

Besides these qualities, Monese’s strengths seem to lie in their multi-currency accounts and global transfer system.

In contrast, the main criticisms of the bank have to do with its customer service and problems regarding account suspension/freezing.

Although they may have paved the way for the ‘new school’ banks, I get the impression they have been left behind in many respects.

Competition in this space is fierce, with the likes of Revolut providing better rates overall.

So, it is my belief, at least for the time being, that there are better options out there than Monese.