A Deep Dive into Plum’s AI-Powered App for Effortless Money Management

We live in a world today in which there is growing animosity towards AI’s capabilities and where it truly stands alongside humans.

Will robots take over the world and render us obsolete? That’s another discussion for another blog! Thankfully, Plum is not a key player in destroying the human race with AI.

Instead, Plum harnesses AI’s logistical powers to create a nifty little app in the personal finance space—making day-to-day budget management so much easier.

The company’s mission is to help combine your finances with artificial intelligence to achieve effortless money management. I’ll show you exactly how this is done and much more in this comprehensive Plum review.

Plum at a Glance

|

What is Plum?

As I alluded to in the introduction, Plum is an app for money management. It was founded in 2016 to make saving and investing easy and hassle-free.

Unlike its competitors, such as Yolt, Plum uses AI to help you with various aspects of personal finance management, including saving, investing, budgeting, and finding better deals on household bills.

By leaving your finances to AI, you eliminate money management’s emotional component, which often holds us back.

If you are unconvinced by this, just think about the last time you persuaded yourself to buy something because you wanted it. This is just something we do as humans, but guess what? Robots do not!

How does Plum work?

Plum works via their app in which users can configure the algorithms according to their preferences when signing up (more on this later).

When you connect your accounts to Plum, the sophisticated AI can access all the information it needs to work at its full potential. From your spending reports, Plum works out the optimal amount you can save regularly without affecting your financial life.

Plum looks like the perfect finance partner so far, doesn’t it?

Plum’s features

What makes Plum really stand out is the array of features the app offers.

In the competitive space of money management apps, all companies want to outdo one another. It’s fair to say Plum has definitely given it a good go, as you’ll see from the features listed below.

(Note: Some of the listed features are only accessible through Plum’s paid versions.)

Saving

One of the main components of Plum is its saving capabilities using artificial intelligence.

That means Plum analyses your expenses and income and determines a safe amount to set aside.

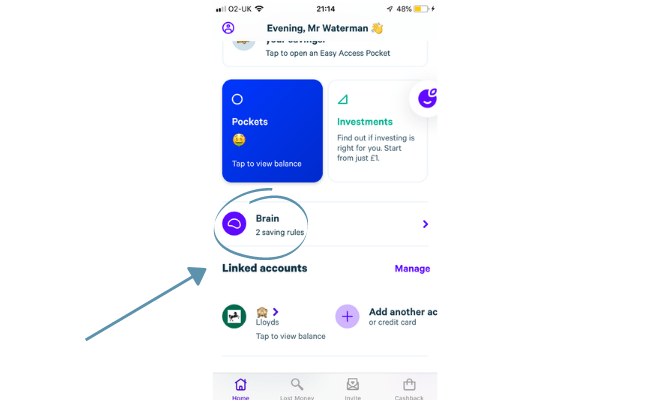

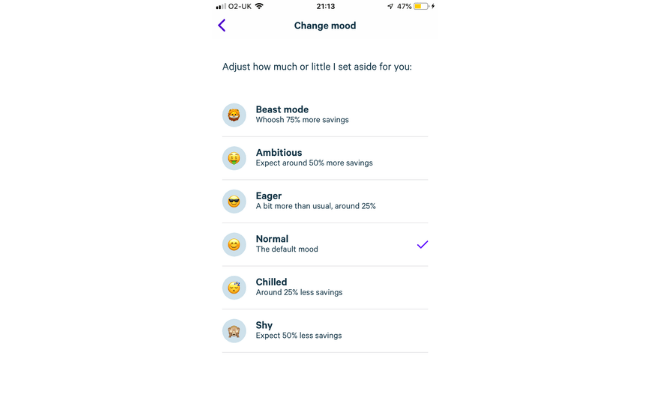

Automatic saving is influenced by the ‘mood’ you set.

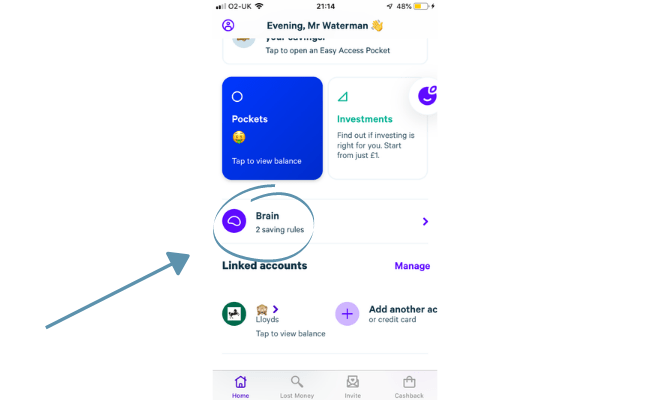

To change your saving setting, click on the brain icon.

Click on ‘automatic’ and scroll down to ‘current mood’.

From here, you can change how much you set aside.

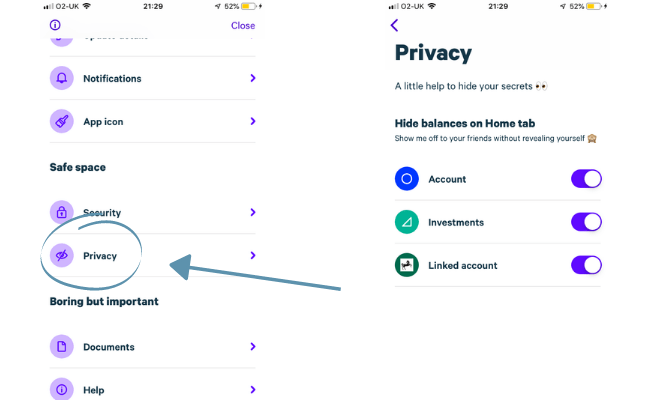

Privacy

Under the privacy settings, you can hide the balances of your account, investments, and linked accounts.

Plum provides this feature so that you can show friends how the app works without ‘revealing yourself’.

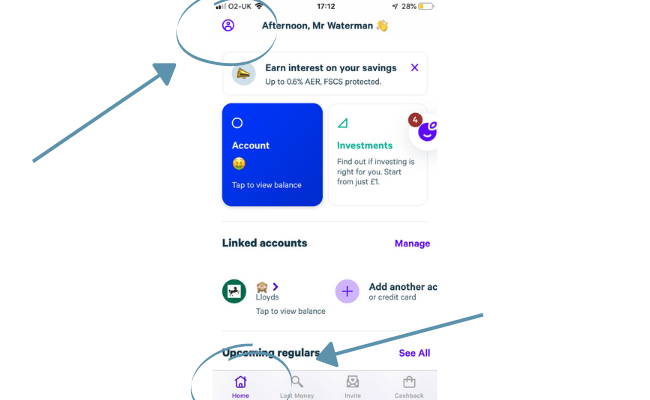

This is a handy little feature to have and one that I only know is shared by its main competitor, Chip. To access this area, you only need to press the icon in the top left-hand corner of the homepage.

Scroll down to ‘safe space’ and click on ‘privacy’.

Roundup is a feature that triggers weekly and rounds your transactions to the nearest pound. It will then transfer the spare change into your savings account.

You also have the option to turn on ‘pound ups’, which puts away £1 for any costs that ends in .00 exactly.

To find the roundup setting, click on the brain icon.

Press ’round-ups’ and set the options to your preference.

Latest transactions

To view the transactions of your linked cards, simply scroll down on the home page and you’ll reach the subheading ‘latest transactions’.

While it may be a common feature, it is still a beneficial one.

Lost money

Lost money is an interesting feature provided by Plum, which essentially details ways in which you could be losing money. Plum believes most people overpay on the following—and they are on a mission to reverse this.

Energy

Enjoy savings of up to £190+ on energy bills in some cases.

Personal loans

Plum will find you pre-approved loans at good rates that suit your current situation.

Broadband

Loyal customers tend to get the worst deals, so swapping could save you a significant sum of money.

Travel insurance

According to Plum’s statistics, 1 in 5 people get the wrong policy and overpay for it.

Car insurance

Finding a new insurer with Plum could help bring down your costs.

Aside from this, Plum also has a couple of sections on cards that could be useful to you: Purchase Card, which lets you spread payments, and Balance Transfer Card, which allows you to bring multiple debts into one place to manage them more easily.

So, not only can this section help you save some money, but it also provides tools with which you can use to improve/manage your financial situation.

To dive deeper into what Plum has to offer on each expense, just head over to ‘lost money’ and click on what you’d like to save on.

Each option has its own process and can be completed fairly quickly with the help of Plum’s AI.

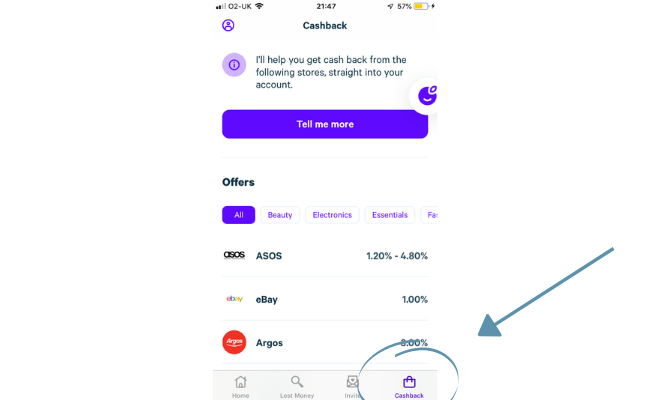

Cashback

(Note: This is a feature exclusive to paid versions)

Plum can help you get cashback from a range of selected stores in all niches.

That money will then go straight into your account!

To browse the available offers, move to the cashback section and select your desired company.

You’ll then be taken to their website, where you can buy some goods with the added bonus of receiving a set cashback percentage.

However, it’s important to note that Plum rewards can’t be used in conjunction with other promotions or offers.

So take advantage of this feature when you don’t have a readily available discount code!

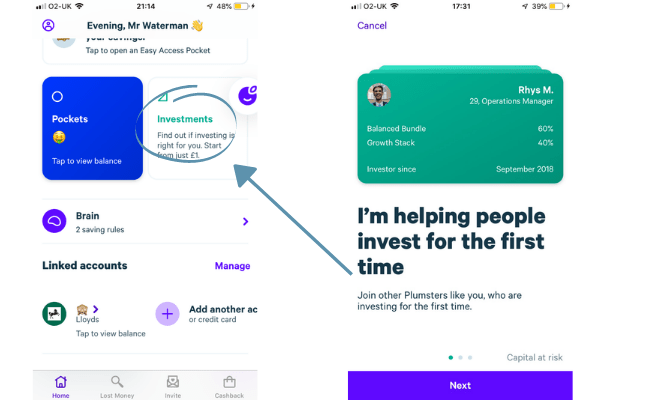

Investing

(Note: This is a feature exclusive to paid versions)As I mentioned elsewhere in this review, Plum allows users to invest a set sum (determined by you) into an ISA or general investment account. Money from general investment accounts can be deposited or withdrawn whenever you like, free of charge. Withdrawals take between 5-7 days.

Plum promotes funds as opposed to single stocks to protect you from bigger downsides.

For those of you who are fairly new to investing, a fund is merely a collection of different companies and/or assets. That means you’ll be buying into a group of businesses, which, in principle, spreads the natural risk that comes with investing.

Some funds also include bonds, which act as a way of being able to lend businesses and governments money at an agreed interest rate.

(Note: Bonds are often considered much safer than stocks and shares.)

Below, you’ll find an up-to-date chart of the funds that Plum has to offer:

| Account types | Basic | Plus | Pro | Ultra |

|---|---|---|---|---|

| Cost | Free | £1 /Monthly (Free for first 30 days) | £3 /Monthly (Free for first 30 days) | £5/ Monthly |

| Savings account | ✅ | ✅ | ✅ | ✅ |

| Investing | ❌ | ✅ | ✅ | ✅ |

| Automated Saving | ✅ | ✅ | ✅ | ✅ |

| Round Ups | ✅ | ✅ | ✅ | ✅ |

| East Access Pocket (FSCS Protected) | ✅ (0.25% AER) | ✅(0.40% AER) | ✅(0.40% AER) | ✅(0.40% AER) |

| Pensions SIPP | ✅ | ✅ | ✅ | ✅ |

| Cashback | ❌ | ❌ | ✅ | ✅ (Enhanced Rate) |

| Pockets | ✅(1 Interest Pocket) | ✅ (1 Interest Pocket) | ✅ (10 Interest Pocket) | ✅ (10 Interest Pocket) |

| Goals | ❌ | ❌ | ✅ | ✅ |

| Rainy Days | ❌ | ❌ | ✅ | ✅ |

| 52 Week Challenge | ❌ | ❌ | ✅ | ✅ |

| True Balance | ❌ | ❌ | ✅ | ✅ |

| Splitter | ✅ | ✅ | ✅ | ✅ |

| Pay Days | ✅ | ✅ | ✅ | ✅ |

| Overdraft Deposits | ✅ | ✅ | ✅ | ✅ |

| Diagnostics reports | ❌ | ❌ | ✅ | ✅ |

| Money Maximiser | ❌ | ❌ | ❌ | ✅ |

To invest in a fund simply click through into the investment section.

Choose a fund, select your investment account type and you’re good to go.

Choose a fund, select your investment account type, and you’re good to go.

Upcoming regulars

‘Upcoming regulars’ give you a heads-up as to when your subscriptions are due.

Under each designated icon, you can find the amount due and the date in an attractive, modern fashion. Clicking on any one will give you some additional data, including the total spend over six months and the account it’s paid from.

Upcoming regulars can be found by scrolling down slightly on the home page.

Invite

Referral programs are always a great way for companies to expand, and it seems Plum shares the same sentiment.

They currently offer £15 for every three friends you get to join the app.

Not only is that a respectable deal, but Plum also makes it easier for you to recruit by connecting your contacts to the app.

That means you can effortlessly find and invite friends that are in your address book.

To invite friends, simply move over to the invite section and connect your contacts.

How much does Plum cost?

Plum offers four different packages. Here’s a side-by-side comparison of what you get in each.

| Account types | Basic | Plus | Pro | Ultra |

|---|---|---|---|---|

| Cost | Free | £1 /Monthly (Free for first 30 days) | £3 /Monthly (Free for first 30 days) | £5/ Monthly |

| Savings account | ✅ | ✅ | ✅ | ✅ |

| Investing | ❌ | ✅ | ✅ | ✅ |

| Automated Saving | ✅ | ✅ | ✅ | ✅ |

| Round Ups | ✅ | ✅ | ✅ | ✅ |

| East Access Pocket (FSCS Protected) | ✅ (0.25% AER) | ✅(0.40% AER) | ✅(0.40% AER) | ✅(0.40% AER) |

| Pensions SIPP | ✅ | ✅ | ✅ | ✅ |

| Cashback | ❌ | ❌ | ✅ | ✅ (Enhanced Rate) |

| Pockets | ✅(1 Interest Pocket) | ✅ (1 Interest Pocket) | ✅ (10 Interest Pocket) | ✅ (10 Interest Pocket) |

| Goals | ❌ | ❌ | ✅ | ✅ |

| Rainy Days | ❌ | ❌ | ✅ | ✅ |

| 52 Week Challenge | ❌ | ❌ | ✅ | ✅ |

| True Balance | ❌ | ❌ | ✅ | ✅ |

| Splitter | ✅ | ✅ | ✅ | ✅ |

| Pay Days | ✅ | ✅ | ✅ | ✅ |

| Overdraft Deposits | ✅ | ✅ | ✅ | ✅ |

| Diagnostics reports | ❌ | ❌ | ✅ | ✅ |

| Money Maximiser | ❌ | ❌ | ❌ | ✅ |

For those of you who are curious about the ultra plan, these are the add-ons that I didn’t include in the features section of this Plum review:

- Goals: Set yourself a target amount, and Plum will help you stay on track.

- Diagnostic Reports: Compare your spending with other users who are financially similar.

- Unlimited Pockets: Splits your money into different categories.

- 52-Week Challenge: Add a pound a week to your savings.

- Rainy Days: Add money to your savings account every time it rains.

- True Balance: Tells you the exact amount you have to spend, taking into account your outgoings, etc.

- Money Maximiser: Calculates your available spending money until your next payday.

Is Plum safe?

Plum is regulated by the Financial Conduct Authority (FCA) to carry out payment service activities. The goals of the FCA are:

- To safeguard customers

- To enhance the integrity of the UK financial system

- To promote healthy competition to improve public service.

This means that a series of safeguards protect your money.

Plum uses the electronic money provider Paynet to set up and administer an E-wallet for you—Plum calls it their ‘instant access pocket’.

In other words, the pocket your money first goes into when opening a free account.

Paynet maintains a specific bank account for all Plum customers with Barclays, protected by E-money safeguarding rules.

Plum further states this about the safety of your money: ‘If either Plum or our E-Money Provider were to go out of business, you can make a claim to get your money back with priority over any potential creditors.’

It’s also important to distinguish that although instant-access pockets are not FSCS protected, both investments and interest pockets are.

So if Plum or their custodians go bust, your money is protected up to £85,000 by the Financial Services Compensation Scheme.

(You can find more about Plum’s safety measures here.)

Plum reviews

Trustpilot reviewers give Plum an overall score of 4.4 out of 5.

This rating was compiled from a collection of over 5,800+ reviews.

77% rated the company as excellent, while 11% rated them as bad.

Analyzing the positive Plum reviews, here’s a summary of what they do well, according to its users:

- Plum not only simplifies saving but makes it easier

- Innovative features

- App is easy to navigate.

Negative Plum reviews talk about things like:

- Slow money transfers

- Chatbox/support

- Referral scheme.

Plum FAQs

Is Plum worth the money?

Plum is a great way to help users save with the help of artificial intelligence.

Does Plum give interest?

Plum’s saving pockets for both currently

Can you make money with Plum

Yes, you can make money from both Plum’s savings accounts. It’s also worth noting that all paid account types on Plum grant you access to investment funds from which you could make money.

Just remember that your capital is at risk when investing.

Which is better: Plum or Moneybox?

Both Plum and Moneybox are similar in terms of the services they deliver. However, Moneybox is very much a simplified version of Plum in that it doesn’t provide as many features or options.

Conclusion of this Plum review

Whether you like it or not, Plum is an innovative company, and they deserve props.

Combining artificial intelligence with finance is not only optimal (from a decision-making standpoint), but frankly, it’s just quite a clever idea.

No doubt, this app can be a useful tool for a wide range of people looking to simplify and automate their savings.

Judging from the many Plum reviews I’ve sifted through, as well as my own experience, many people are in agreement.

Having said that, many alternatives to Plum offer similar features that, in some cases, are cheaper and better. That’s why it pays to play the field and explore Plum’s competitors.

Luckily, I’ve already done the hard work for you, and you can find the comprehensive software review posts below:

Aside from money management apps, many ‘new school’ banks have adopted saving and investing features, such as:

As always, if you enjoyed this Plum review, feel free to leave a comment and/or share this post on social media.