What if there was a way that you could save and invest your spare change without having to manage it yourself?

You’d say that I sound like a bit of an idealist. Well, what if I told you that there is a company out there that goes by the name of Moneybox that does exactly that?

When Moneybox first hit the market in 2015, it gained significant traction due to its simple round up feature. This feature allowed you to round up your spending to the nearest pound and deposit the extra money into a savings pot.

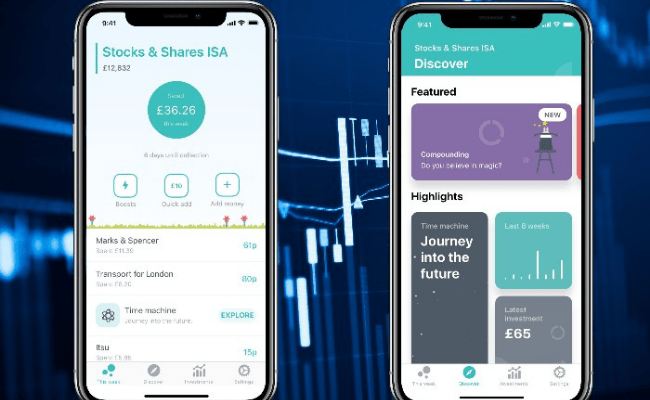

Fast forward to today, and Moneybox has evolved from a basic savings app into a comprehensive investment platform.

Moneybox at a Glance

|

Moneybox: Is It the Top Investment App for Your Spare Change?

What is Moneybox?

Moneybox is an award-winning U.K.-based investment app that allows users to save and invest in a variety of assets, including stocks and shares, bonds, and commodities. The company was founded in 2015 by Ben Stanway and Charlie Mortimer.

The company has positioned itself in such a way that it appeals particularly, although not exclusively, to new investors.

In other words, people who want to invest their spare change but don’t know where or how to get started. By handling all the investments themselves, Moneybox enables users to save and invest ‘hands-free’. That way, people can go about their everyday lives knowing that they have a saving and investing system in place behind the scenes.

Today, over 1 million customers save and invest with Moneybox. Plus, the company was ranked 26th in the Deloitte U.K. Technology Fast 50 as one of the fastest-growing technology companies in the U.K..

How does Moneybox work?

First, you have to be 18 or over to open an account with Moneybox. You simply download the app, which is available on both Android and IOS devices, and sign up. Here’s a quick, step-by-step guide to take you through the sign-up process. It takes only a couple of minutes.

- Download the App: Download and install the Moneybox app from the Apple App Store or Google Play Store. You can also download the app from the Moneybox homepage.

- You’ll be asked for the following details: Bank account details to set up a direct debit; National Insurance Number if you’re opening a Stocks & Shares ISA, Cash ISA, Lifetime ISA, or Personal Pension (not needed for a General Investment Account, Simple Saver, or Notice Accounts); and online banking or credit card details if you want to use round ups.

- Select Account: Choose the type of account you want to open and the amount you wish to invest weekly, with the option to add a lump sum.

- Complete Setup: Provide the necessary details and follow the prompts in the app to set up your account.

- Start Investing: Once your account is set up, you can start investing with as little as £1 and contribute through various methods like round ups, one-off deposits, weekly deposits, and monthly boosts.

At this point, you might be wondering what are round ups? Well, it’s just that — a money box. And it works like this: Once you link a bank account, the app will round up your transactions to the nearest pound and set aside your spare change for you to invest or save.

So say, for example, you spend £1.50 on a coffee, Moneybox will then round it up and save £0.50 for you.

(To see the full list of banks that support round ups, click here)

What are the different Moneybox account types?

When it comes to saving or investing with Moneybox, you have a variety of products to choose from. So it’s only right that we cover all of them in this Moneybox review. But before we do, let’s first break down the fees associated with Moneybox’s investment accounts:

Stocks & Shares ISA

| Stocks & Shares ISA | |

| Subscription Fee | £1 fee/month regardless of the number of investment accounts you have with Moneybox

(free for the first 3 months) |

| Platform Fee | 0.45% of the value of your investments per year (plus an additional 0.45% currency conversion fee if you invest in US stocks) |

| Fund Provider Fee | Up to 0.58% |

Stocks and shares ISAs allow you to invest up to £20,000 a year tax-free. Your round ups and/or direct deposits can be funnelled into this account type to be invested in the stock market.

This gives you exposure to thousands of publicly traded companies around the globe.

Just remember that investing always carries risk, and you can walk away with less money than you put in.

A socially responsible option is also available for those of you who want to invest only in ethical and/or green companies.

Lifetime ISA

Lifetime ISAs are used for people who are looking to buy their first home or use it for retirement. Account holders can deposit up to £4,000 a year, and in return, they’ll receive 25% on top from the government.

On top of that, Moneybox offers a variable interest rate of 4.40% AER, which includes a 3.50% variable base rate and a fixed one-year bonus interest rate of 0.90%.

You can get started for as little as £1. Just be aware that if you withdraw the funds for other reasons than those mentioned above, you’ll pay a 25% penalty.

Savings account

Moneybox has what’s known as a short-term goals account, which gives you access to slightly higher interest rates. Moneybox says these are ideal for those of us who want to work towards our short-term goals.

You have two options to choose from, each with its own characteristics: A 95-day notice account or a 45-day notice account. Let’s look at their key characteristics side-by-side:

| Characteristic | 95-Day Notice Account | 45-Day Notice Account |

|---|---|---|

| Interest rate | 0.6% AER (variable) | 0.45% AER (variable) |

| Notice period | 95 days notice before withdrawal | Give 45 days notice before withdrawal |

| Saving | Save up to £85,000 | Save up to £85,000 |

| Deposit limit | Weekly deposit limit of £20,000 | N/A |

| Underwriter | Powered by Investec | Powered by Charter savings bank |

| Fees | No account fees | No account fees |

| Other information | Continue to earn interest in the withdrawal period | Continue to earn interest in the withdrawal period |

Personal pension

Consolidate your pensions into one easily manageable Moneybox Pension that lets you take control of your retirement savings. As with all pensions, you’ll receive a 25% tax relief from the government. However, here are a few things to consider:

- Moneybox can’t accept transferrals from your provider(s) if they charge you to leave

- Or if you might lose guaranteed benefits

- Moneybox doesn’t currently offer drawdown products

- There’s an annual allowance of £40,000

- For the first £100,000 in your Moneybox Personal Pension the fee is 0,45% per year

- You’ll also have to pay a fund provider fee ranging from 0.14%-0.58%.

Junior ISA

Parents or guardians can open Junior ISAs for anyone under the age of 18. Like a stocks and shares ISA, all funds are invested in the stock market, but junior ISAs have a tax-free limit of £9,000 a year (subject to change) that does not count towards your own ISA allowance of £20,000.

You can also receive gifted deposits from friends and family, which is a nice value add of the Junior ISA.

Once the child turns 18, the funds are automatically transferred to them. You should also bear in mind that money cannot be withdrawn from the account before the child is 18 unless a significant event occurs.

General investment account

General investment accounts are used when individuals have reached the maximum limit for their stocks and shares ISA.

This form of account does not have the same tax benefits, but you only pay tax on gains above £6,000.

The one major benefit of having a GIA is that it has no limit to the amount of money you can hold in the account, but weekly deposits are limited to £85,000.

Moneybox’s investment styles

After choosing your account type, you can choose 1 of 3 investment styles that most suit your tolerance to risk.

Bear in mind these investment styles only apply to the following account types.

- Stocks and Shares ISA (Including socially responsible option)

- General Investment Account

- Pension Account

Below are the investment-style labels.

- Cautious: Modest growth with reduced risk

- Balanced: More growth with more risk

- Adventurous: High growth with a heightened risk

Experts at Moneybox optimise each investment option, and these starting options comprise tracker funds.

Tracker funds simply mimic broad market indexes, recreating their holdings and performance.

You can customise the asset allocation, but just make sure you understand the implications of doing so.

Is Moneybox safe?

Moneybox is regulated by the Financial Conduct Authority (FCA), which upholds a strict and strong set of guidelines/rules. The main goals of the FCA are to safeguard customers, strengthen the integrity of the U.K. financial system, and promote healthy competition in the interests of consumers.

Aside from that, investment products are protected by the Financial Service Compensation Scheme (FSCS) up to £85,000.

The only fund they use that the FSCS does not protect is the old mutual world ESG index fund.

This is because they are situated in Ireland and adhere to different rules.

Moneybox competitors

Given the competitiveness of this space, it’s only right that we compare Moneybox to other key players in the industry to see how they stack up. We’ve compared it to three other competitors below.

(If you want to look at a range of potential candidates, check out my reviews section)

Moneybox vs. Plum

Plum is predominantly a savings app that utilises AI to put money aside for you each week.

Like Moneybox, you can enable round ups, among other things, to help increase your savings.

Plum differs when it comes to account types, offering only a free savings pocket (0.35%) and the option to invest in a choice of funds.

To read more about Plum, I recommend reading my review, which is linked below.

Related: Plum Review

Moneybox vs. Chip

Chip is purely a savings app and currently offers no investment products (this may change soon).

Its strengths lie in its simplicity and effectiveness—it ‘does what it says on the tin’. If you are purely looking for something that can help you save and are put off by the risk of investing, Chip could be an option for you.

Chip does charge a fee, albeit small at £1 for every time the app saves you £100 through their automatic savings feature.

They have also recently introduced their ‘interest accounts’ which pay a 0.9% rate, which could interest some of you.

To read more about chip, check out my review linked below.

Related: Chip Review

Moneybox vs. Nutmeg

Nutmeg is a digital wealth management company and so it’s more tailored to growing your money through investments. That said, it provides similar account types to that of moneybox.

- Stocks and shares ISA (including socially responsible option)

- General Investment Account

- Pension

- Junior ISA

You also have options when it comes to risk tolerance, up to 10 different levels for some account types.

In summary, if you don’t have a problem saving, this may be better suited to you.

If you would like to read more about Nutmeg, check out the review below.

Related: Nutmeg Review

Moneybox reviews

According to Trustpilot, Moneybox has an overall rating of excellent from over 1,700 reviews.

78% of the Moneybox reviews gave a rating of 5 stars, while 10% rated them as bad.

Positive Moneybox reviews include things like excellent service, ease of use, and great way to save and invest.

Negative Moneybox reviews tend to touch on things such as delays with customer service, difficulty withdrawing money when users closed their bank accounts, and problems deleting accounts.

Customer service does tend to be a subjective experience and in some instances, they’ll be issues in which the customer feels unsatisfied.

This is a problem every business has. When it comes to trying to withdraw to a different account, companies in the finance sector are under strict rules and obligations.

This is to ensure no fraudulent activities are taking place through their platform. Nevertheless, I can understand some people’s frustration.

Moneybox FAQs

Is Moneybox worth it?

When questioning a service’s worth, it’s hard to say since it’s subjective by nature.

Factors such as your tolerance to risk and overall market conditions will be the key players in your returns and, ultimately, your judgement on whether or not you think it’s worth it.

However, I will say that putting money aside each month for investment is a healthy practice in broader terms.

Is Moneybox legit?

Moneybox is regulated by the FCA, meaning they have to adhere to strict rules and regulations to offer financial services to the U.K. public. So rest assured Moneybox is 100% a legitimate company.

Who owns Moneybox?

Moneybox is owned by its co-founders, Ben Stanway and Charlie Mortimer.

Is Moneybox good?

This question is subjective in nature, making it hard to give a response that will represent everyone. But what I will say is that, in my opinion, Moneybox is good for those of you who are new to investing and are looking for a ‘hands-off’ approach.

Our final verdict on Moneybox

Now that this Moneybox review is drawing to a close, I hope you have a better idea of what they are all about.

The concept of Moneybox is a good one. It allows users to save and potentially earn returns when they spend.

The variety of accounts is also useful for those of us at different stages in our lives.

Having said that, this app feels like more of an introduction to investing, yet it has no educational component to it.

This may suit some people, but the likely slow returns from small amounts invested could put some people off investing for good. That would be a great shame.

When it comes to saving with the app, round-ups are really its only noteworthy feature. There are plenty of other savings apps out there which have a multitude of additional savings features.

In conclusion, Moneybox is suitable for those of you who are new to investing and aren’t too fussed about learning more about it.

If you enjoyed this Moneybox review, consider checking out our socials so you can stay up to date with recent posts.

Equally, if you have any questions about this Moneybox review, drop a comment, and I’ll answer as soon as I can.