Given all the recent commotion in the investment world, many of you have asked for a review of Trading 212. You should know by now that I never like to disappoint my readers, so here we are!

Let’s unpack what you need to know about Trading 212 in this review.

What Is Trading 212?

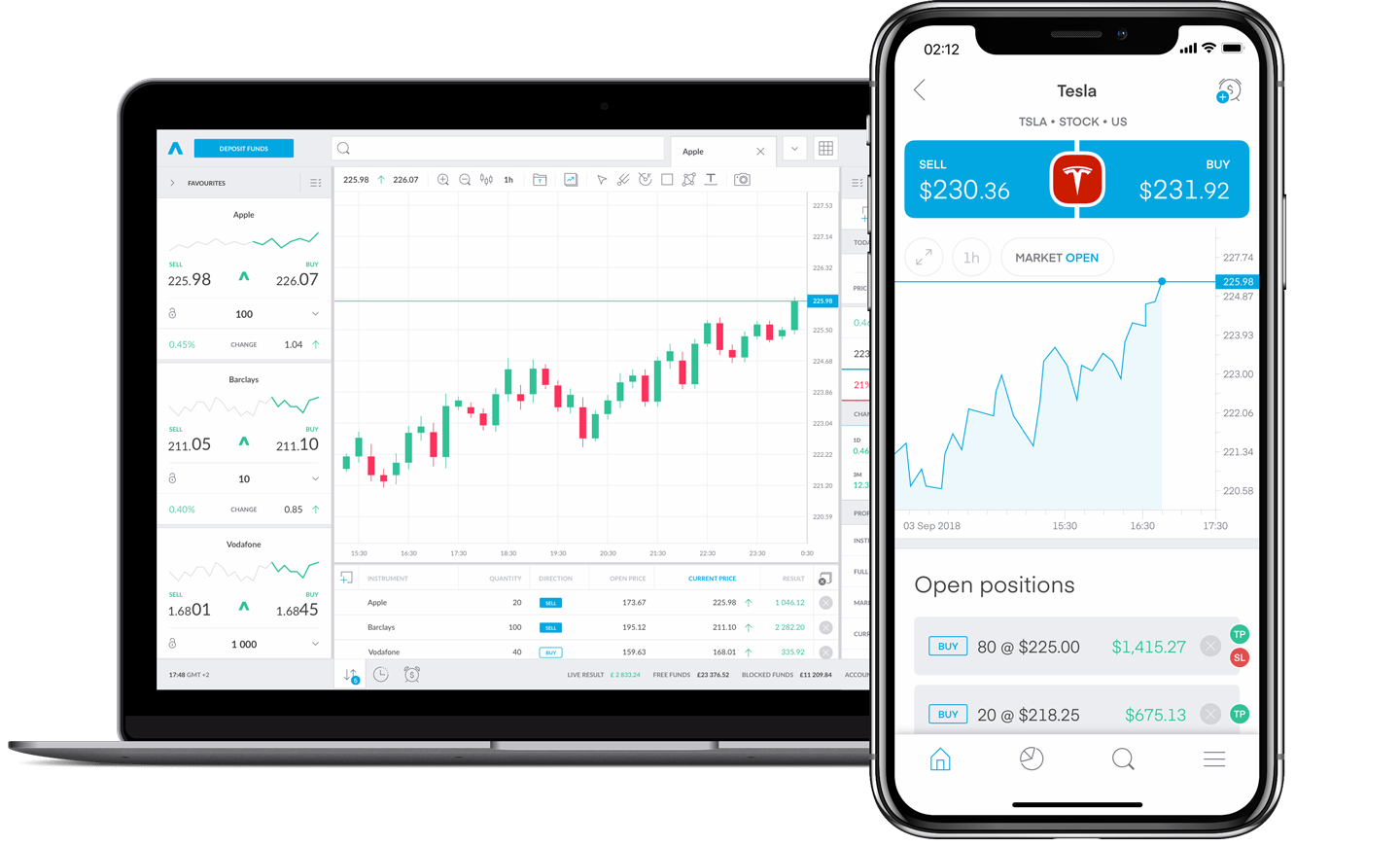

Established in 2006, Trading 212 is a London-based fintech company that owns more than £3.5 billion in cash and assets. It offers commission-free stock trading, fractional shares, auto-invest, pies, and invest by value. Trading 212 started with the goal of democratising the financial markets and making investing more accessible for people like you and me.

Before Trading 212, in Europe, at least, you could face a small range of fees for trading financial products. When you tallied up these fees, they were expensive enough to discourage the majority of the public from trading.

So, as you can imagine, Trading 212 was welcomed with open arms and has steadily grown ever since. Here are a few notable accolades that support this:

- Trading 212 has been the UK’s most popular trading app since 2016

- It’s been the most popular in Germany since 2017

- More than 15 million mobile app downloads

- 1.28 million+ subscribers on YouTube.

Trading 212 Account Types

When it comes to choosing an account type, you can select from the following options:

Stocks & Shares ISA

A Stocks & Shares ISA (Individual Savings Account) is a tax-efficient way to invest in publicly traded companies. Currently, you can invest up to £20,000 a tax year in a stock and shares ISA without paying tax on any of your returns.

Here are the main features of this product:

- Commission-free trading

- Withdrawals take two business days

- Trade-in euros, pounds, and dollars

- Set up direct debits (£10 minimum).

Related: Learn more about ISA and investment platforms.

General Investments Account (GIA)

A GIA, or Trading 212 Invest as it’s known on the platform, is often used by investors who have reached the £20,000 limit on their ISA. It’s similar to an ISA but has a few key differences:

- GIAs are subject to capital gains tax on profits over £6,000 in a tax year

- GIAs have no deposit limits

- Wider variety of stocks to choose from

- You hold a variety of currencies in your investment account

- You can choose from 10,000 shares and ETFs with a minimum investment of £1.

Contracts for Differences (CFDs)

Trading 212 offers CFD accounts for more sophisticated brokers. These investments pay the difference in the settlement price between the opening and closing trades. Investment vehicles that fall into this category are:

- Forex

- Indices

- Commodities (silver, oil, etc.).

There is a 0.5% fee when trading in other currencies and a spread fee, which is the difference between the buy and sell prices of the currency pairs.

Safety measures are put in place to protect users active on CFD accounts, yet statistics show that 78% of people lose money trading CFDs. Our advice is to be cautious when using this account type.

Trading 212 Demo Account

A Trading 212 demo account is a practice account provided by the Trading 212 platform that allows users to trade with £5,000 of virtual funds, enabling them to practice trading without risking real money.

Trading 212 Pro

Trading 212 Pro is a professional CFD account that offers higher leverage, with ratios of up to 1:500. To become a pro client of Trading 212, you must hold a CFD retail account with Trading 212 UK Ltd. entity and meet at least two of the following criteria:

- Carrying out a minimum of 10 significantly sized trades each quarter over the last year

- Having a financial portfolio worth €500K or more, or

- Working or having worked in the financial sector for at least one year in a professional position requiring knowledge of leveraged trading/CFDs and their derivatives.

The pro account is exclusively for CFDs and the only advantage is the increased leverage. To qualify for this account, you must provide evidence of meeting two out of three qualifications: a €500K portfolio, experience with levered derivatives, or a history of significant trades.

Trading 212 Features

Trading 212 offers a range of features on its platform, and we cover all of them in this Trading 212 review UK. My Trading 212 app review will also show you how to access each of them via the app so you get a feel for the layout of Trading 212.

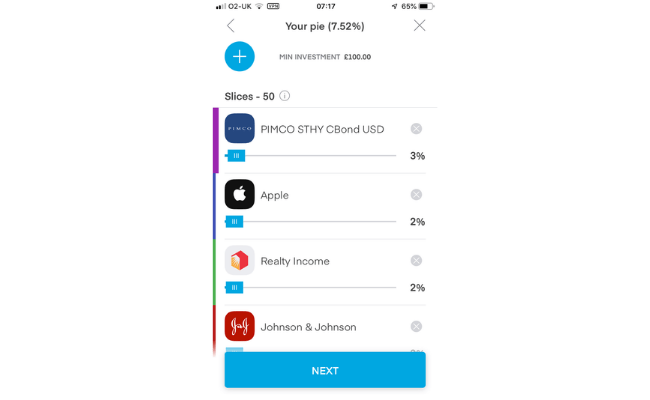

Pies

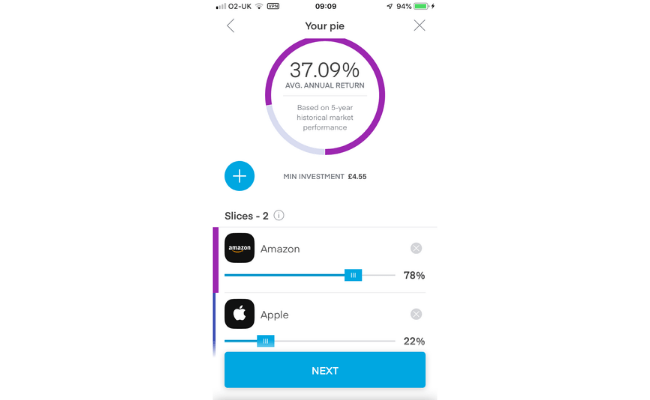

Pies allow users to own up to 100 securities. These securities, including ETFs and stocks, are divided into portions within the pie.

Here is an example:

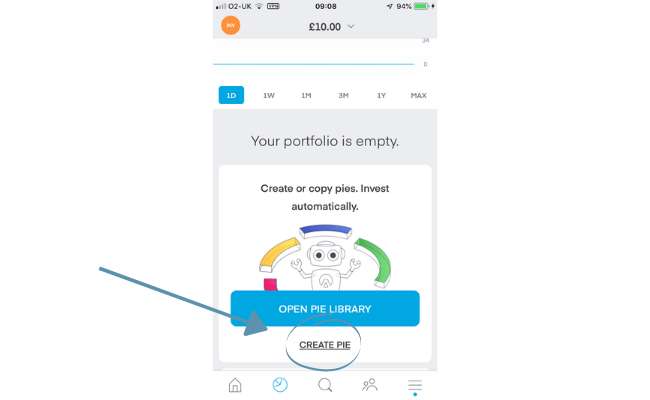

It’s easy to adjust the allocation of your funds within the pie using the slider. To create your own pie, follow these steps:

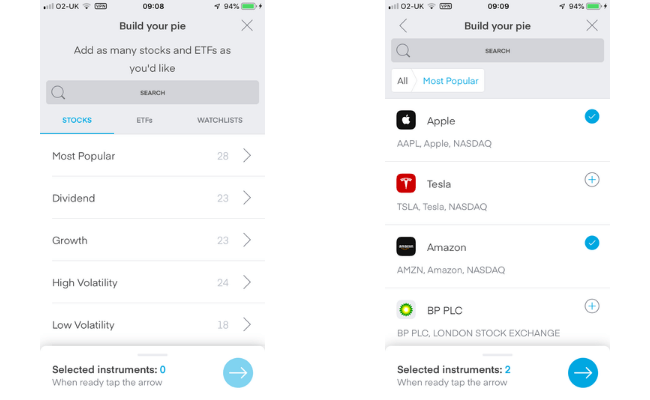

1.Go to the chart icon at the bottom and select ‘create a pie’.

2. Browse through predefined categories or search for specific stocks to add to your pie.

3. Once you’ve added the desired stocks, adjust the capital allocation for each stock until you’re satisfied.

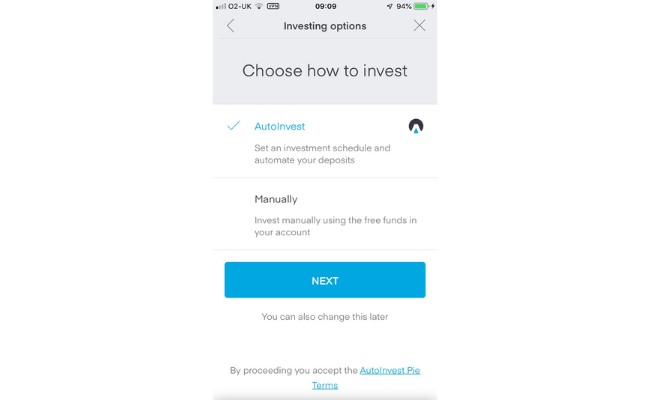

4. Next, you need to fill out your investment options, i.e. whether or not you want to invest manually or automatically.

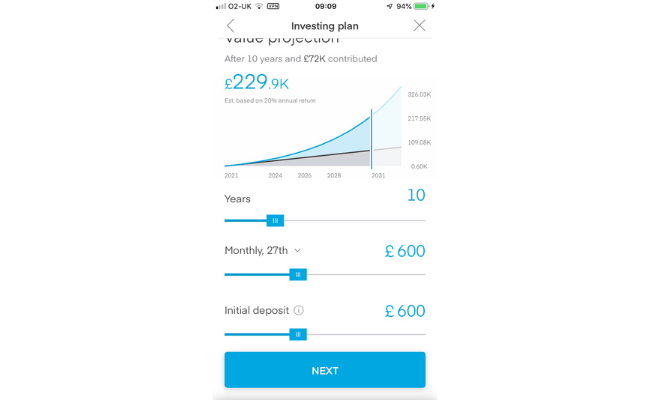

5. This is then followed by your investing plan, which includes:

- Duration

- Reoccurring deposit date

- Initial deposit amount.

6. The adjustments you make to each option will also be reflected in the predicted earnings graph at the top.

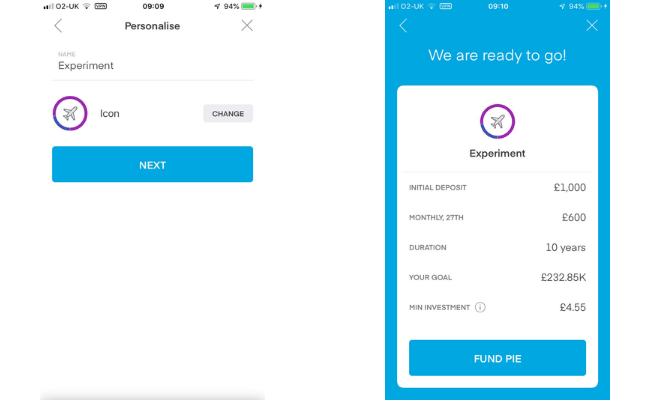

7. Finally, personalise your pie by choosing an icon and name.

- Icon

- Name

Once you’ve done that, you will have successfully created a pie with Trading 212.

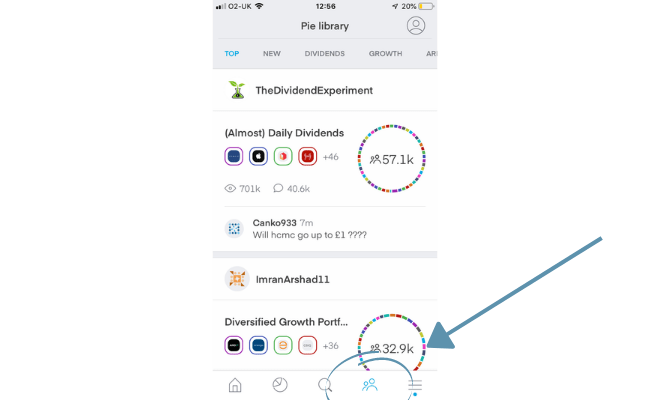

Users can also share and copy each other’s pies through a technique known as copy trading, which is a great option for those new to investing but who prefer a more hands-off approach.

To access this feature, simply go to the ‘pie library’ section.

Filters are available to help you find pie options that interest you.

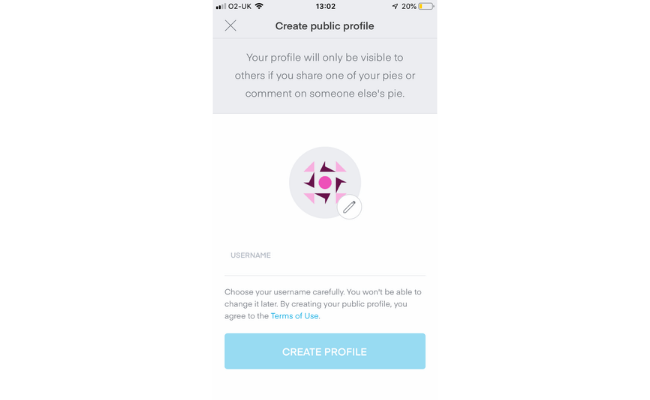

Additionally, you have the option to create a public account, which will be visible if you share your pie or comment on someone else’s.

Auto Invest

In addition to pies, Trading 212 offers an auto-invest feature for those who prefer a ‘hands-off’ investing approach.

All you need to do is set these two things:

- The amount you want to invest

- The frequency of the investments.

You can find the auto-invest setup in the above walkthrough of how to create a pie.

Fractional Shares

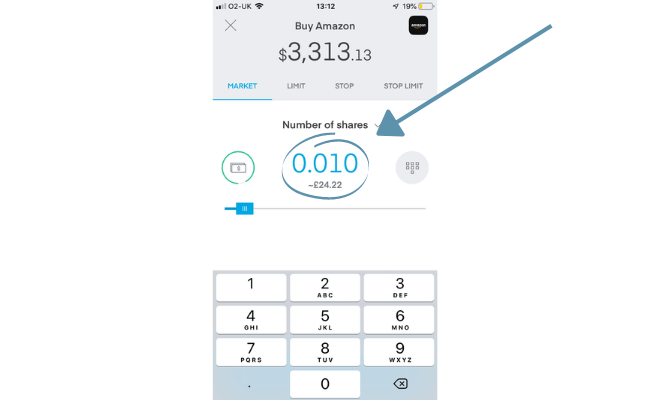

Fractional shares are portions of one full share.

These shares allow users who cannot afford full shares to invest in the companies they desire.

For example, Amazon is one of the largest companies in the world, with shares currently trading at around $170.46. Fractional shares enable individuals who can’t afford a full share of Amazon to invest in the company.

To buy a fractional share, simply click ‘buy’ next to a stock and enter the amount you want to invest. Trading 212 will then give you its share value equivalent.

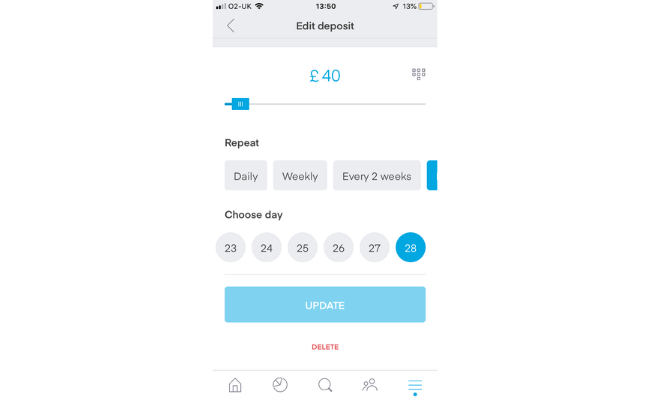

Direct Debits

Direct debits are a straightforward yet useful feature. They encourage consistent investing and only require a minimum deposit of £10 to set up.

Unfortunately, this feature cannot currently be used in conjunction with any existing pies or a specific stock.

However, there have been numerous requests on Trading 212’s forum to implement this, so it may be a change we see in the near future.

To set up a direct debit, go to ‘manage funds’, click ‘deposit schedule’, and choose your desired conditions.

Portfolio Allocation

When you’ve got some investments, your portfolio allocation is a nice little feature to look at. Each investment is represented as a percentage, providing you with a clearer picture of your portfolio. It is also helpful to view your portfolio in a more visual format.

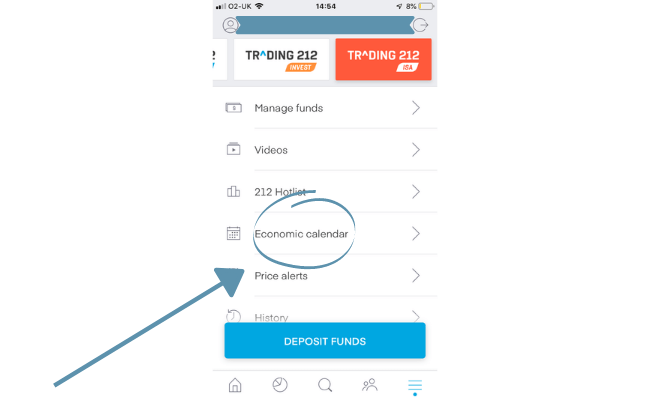

Economic Calendar

The economic calendar is a valuable addition to Trading 212’s features as it provides details on important upcoming events.

These are events that could have an impact on particular stocks (earnings dates, etc.) or the stock market in general.

Metrics can be found at the bottom of each event, including:

- Actual – The confirmed result after it occurs

- Forecast – Predicted outcome

- Previous – Prior outcomes of the same event.

A description is also provided if a particular event is of interest to you.

To access the calendar, move over to the menu and press ‘economic calendar’.

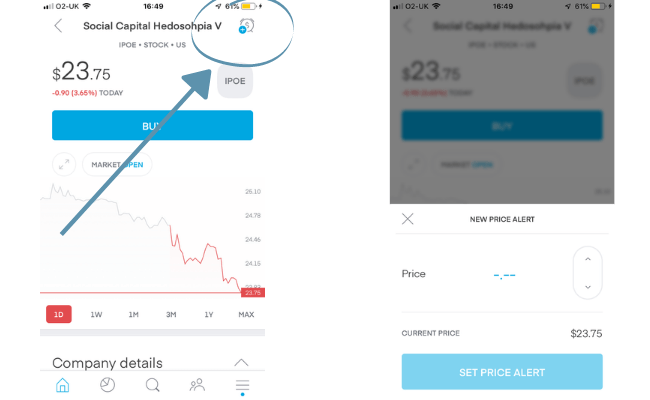

Price Alerts

Price alerts can be set for either buying or selling and serve as a helpful tool for all investors.

You will receive a notification when the set amount is reached. It is worth noting that you can place an unlimited number of price alerts on any stock of your choice.

To set up price alerts, simply choose a stock and click the icon in the top right-hand corner. Set the price you want.

It’ll then trigger a notification if it’s reached from that point onwards.

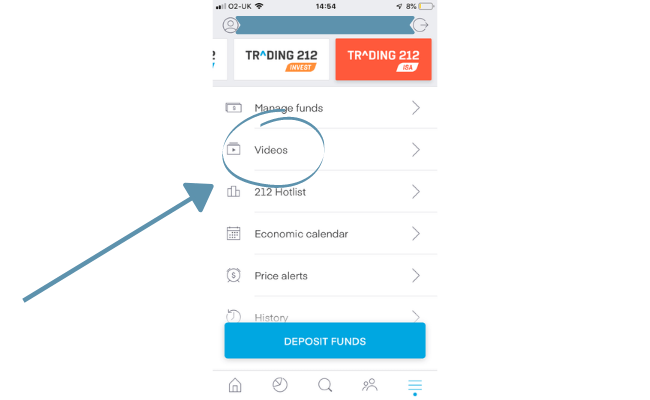

Training Videos

If you are new to investing, it can be quite daunting, to say the least. That’s why Trading 212 has put together a collection of training videos for their users.

It won’t just be helpful to new investors but for experienced investors, too.

They cover a wide range of topics including:

- How to use the app

- Technical analysis

- Pairs trading

- Fundamentals

To access these training clips, just move over to videos that are located on the menu.

From here, you can sift through clips and watch those that’ll be of value to you.

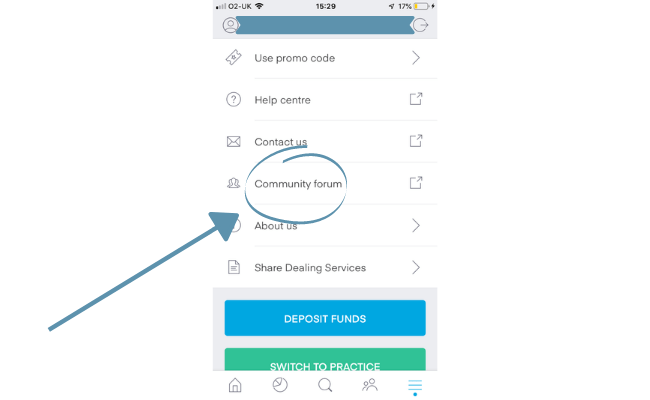

Community Forum

As mentioned earlier, Trading 212 users can share ideas and make requests for new features on the forum. This helpful community is worth exploring.

Often, questions you may have, have already been asked by other users, so you can quickly find suitable answers. This will save you from potentially having to wait for support.

To view the forum, navigate to ‘Community Forum’, click on it on the menu, and it’ll take you to their dedicated page.

Refer a Friend

Trading 212 has an excellent ‘refer a friend’ scheme. When you refer a friend by sharing the referral link, both of you get a free share worth up to £100. The company usually open this offer once or twice a month, and you can refer up to 5 friends during that timeframe.

It’s a great way to earn some extra money. For example, I sent it to my WhatsApp group with my friends and got 5 sign-ups, we all earn!

How does Trading 212 make money?

Trading 212 mainly makes money through its CFD platform, which charges a 0.5% fee for currency conversions. It further generates revenue through various sources, including overnight weekend fees, conversion costs, and interest swap transactions.

The company also earns money by lending out shares, charging FX fees, and earning interest on uninvested cash. They charge an FX conversion fee of 0.15%, which applies to ISAs and GIAs

Additionally, Trading 212 makes money through spreads between the buy and sell prices.

Is Trading 212 safe?

Trading 212 is licensed by three regulatory bodies, including the UK’s prestigious Financial Conduct Authority (FCA), making it a highly trusted and safe broker. The company’s parent firm is based out of Bulgaria, where it is regulated by the Bulgarian Financial Supervision Commission.

Any funds held by Trading 212 are kept in a segregated account separate from their own to protect your money in case of insolvency.

In the unlikely event of insolvency, your funds are further protected by the Financial Services Compensation Scheme (FSCS), up to £85,000.

Trading 212 also conducts regular penetration tests and scans on their applications to ensure the security of your personal data. So, rest assured your funds are safe.

Trading 212 reviews

Looking at the reviews of Trading 212 on Trustpilot, we can see that it has an excellent score. Out of over 25,037 reviews, 76% have given them a 5-star rating, while only 7% rated them 1-star. Positive Trading 212 reviews include comments such as:

- Always been a good trading platform

- Quick and easy to use especially the app

- Great experience with ISA Transfer.

Typical negative Trading 212 reviews include things like:

- Not allowed to buy certain stocks

- Withdrawal issues including slow withdrawal porcess

- The server crashes too often.

FAQs

Is Trading 212 legit?

Of course. Any large company offering financial services in the UK must adhere to strict rules and guidelines, and Trading 212 is no exception. As I mentioned above, Trading 212 is regulated by the Financial Conduct Authority, whose job it is to keep finance companies ‘inline’.

Is Trading 212 good for beginners?

Trading 212 is generally considered a good platform for beginners. It offers commission-free trading, a user-friendly interface, and practice portfolio accounts to get you starated.

Can you short on trading 212?

Yes. That includes every stock on the platform and across the various account types (ISAs, GIAs, CFDs)

Can I transfer shares to Trading 212?

Unfortunately, this is not possible. You can, however, transfer your ISA to another broker, provided you have sold all your existing holdings. In this case, the cash can be transferred to your ISA, and the transfer will be free of charge.

Can you make money on Trading 212?

Absolutely! Making money on Trading 212 is entirely possible. However, you have to remember that when dealing with financial markets, there is always a degree of risk involved.

How to sell on Trading 212?

- Log in to your account.

- Navigate to the trading section.

- Choose the asset to sell.

- Open a sell order.

- Specify quantity and price.

- Review and confirm the order.

You need to have funds in your account and monitor market conditions.

Does Trading 212 pay dividends?

Trading 212 offers a wide variety of dividend-paying stocks for investment. You will find a dedicated section for dividend stocks located near the stock search bar.

Can you day trade on Trading 212?

Yes, you can trade as much as you like with as much as you like in any given period using either the app or web platform. It’s also worth noting there are no limitations or fees for this style of trading either.

Conclusion of our Trading 212 review

Now that this Trading 212 review is drawing to a close, I hope that you have a better idea about the company as a whole.

Lastly, before diving into platforms like Trading 212, take a moment to educate yourself on money and financial matters. This will serve as a reliable partner in your trading journey. Having a grasp on investing basics, market trends, and risk management can make the journey safe and straightforward!

Enough so that you can come to an informed decision as to whether it’s right for you.

If you enjoyed this Trading 212 review, consider checking out our socials so you can stay up to date with new posts.