Our general review of Kroo Bank in a nutshell

Kroo Bank is quite attractive in a lot of ways. However, due to its relatively new status, there are still several areas it can improve on.

On the pros side, it provides fee-free current accounts that are quick and simple to open. It offers a 4.35% AER interest rate and has no foreign transaction fees – AER stands for Annual Equivalent Rate, and it represents what your rate would be if interest were paid and compounded once a year. Plus it has environmentalism and social consciousness at the heart of its operations.

On the cons side, you might need to use another bank alongside it if you want a savings account as it doesn’t offer this yet. There is no physical branch, so you can only access your account in-app.

Who is Kroo Bank?

Founded in 2016 as B-Social, Kroo Bank officially launched its FSCS-Covered services in 2022 after securing a full banking license. Its approach is based on openness and ethical practices, with a guarantee that your money is saved and invested in a way that reflects your values and ideals.

Kroo Bank’s dedication to this ethos is a deeply established aspect of its operations. At first glance, it seems quite like its direct competition: Monzo, Revolut, Chase, Starling, because they mainly appeal to a younger and more digitally inclined demographic. If you take a closer look, however, you will notice just how much its socially conscious approach sets it apart from others.

An important example is the company’s goal of planting one million trees by the end of 2024, with two trees planted for every new customer—and the customer gets to decide where the trees are planted too. Aside from this, Kroo Bank also commits to supporting green initiatives around the world.

Beyond Kroo Bank’s laudable environmentalist endeavours, it has also disrupted its core area of business—the banking industry. Unlike the usual savings account dynamic, Kroo Bank decided to shake up the space by paying its current account holders 4.35% AER (4.27% gross) on balances up to £500,000. Even better, this interest is paid monthly. Such an audacious move definitely got everyone’s attention.

However, this new player in the financial sector is not without its flaws. In the sections that follow, we will dissect the bank’s nuances, explore its strengths and weaknesses, and help you decide if it’s the right bank for you.

How safe is Kroo Bank?

Kroo Bank is a fully licenced UK bank that is regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). This cover ensures that the bank satisfies specific criteria and regulations. It is insured by the Financial Services Compensation Scheme (FSCS), which protects your savings up to £85,000.

The Kroo card is issued by PayrNet Limited which the FCA licenses. The Electronic Money Regulations of 2011 mandates PayrNet to hold all customer funds in a segregated account that is subject to safeguarding procedures. Under this cover, your money is safe from creditors’ claims in case PayrNet Limited becomes insolvent

Additionally, the Kroo Bank app employs secure 256-bit data encryption to protect your information. For further protection, you’re able to turn off or freeze the card when it is not in use.

If you are still unsatisfied with all these security parameters, that’s not a problem. Kroo Bank’s FSCS protection means you’re free to complain to the Financial Ombudsman for any aggrievement you feel about its services.

What benefits come with a Kroo Bank account?

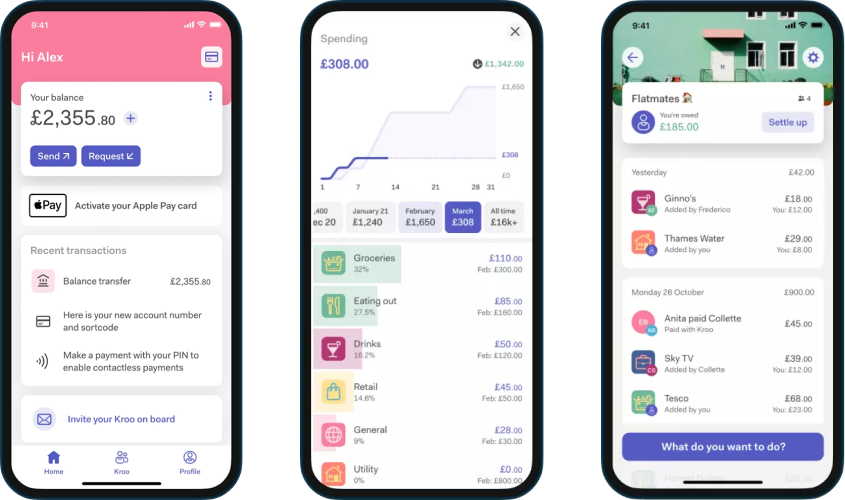

Kroo Bank’s current account comes with a debit card. It has no opening or monthly fees, making it one of the cheapest options available. It offers a fully digital experience on its user-friendly app, gives you timely notifications on your transactions, and provides you with easy-to-understand insights into your spending habits.

One of Kroo Bank’s key goals is the elimination of the awkwardness that often trails financial engagements with friends and family, such as splitting a restaurant, shopping, or vacation bills. As a result, the bank allows customers to form multiple groups with friends (or family) for shared spending. Likewise, Kroo Bank offers distinct savings accounts in the form of Pots. These accounts are designed to help customers divide their daily expenses from their savings.

When it comes to travel, Kroo Bank prides itself as a valuable companion. You’re able to use your Kroo card internationally without incurring extra charges. This includes overseas ATM withdrawals, although there are indications that this might change from April 2024. Also, it’s important to remember that several ATM providers may charge for withdrawals on their machines and Kroo Bank has no control over that.

One of Kroo Bank’s biggest attractions is its unbeatable 4.35% AER (4.27% gross) interest rate on in-current account balances. Another impressive factor here is that this interest is paid monthly, and can be paid on balances up to £500,000.

There are no limits for deposits, but there is a £250,000 limit on daily transfers and a £10,000 limit on daily card spending. The Bank’s dedication to minimal fees is a key selling factor. Overdraft fees, transaction fees, and other hidden expenses that often eat into balances in other banks are absent with Kroo Bank.

Like many other banks, there are overdraft opportunities with Kroo Bank, but at the moment, they are only available by invitation. The bank is, however, happy to offer its customers personal loans of up to £15,000. This will, of course, be subject to checks, but the bank commits to giving immediate decisions for its loan applications.

When it comes to how easy it is to use the Kroo Bank app, the bank scores highly in this area. Even for new users, it is easy to notice how much effort has been put into making sure that every aspect of the app is simplified. The bank employs a refreshing user-centric approach which removes the complexity that often discourages consumers from engaging with their bank.

This simplicity is a core strength that makes Kroo Bank a great alternative for those who desire a simple, no-frills banking experience. One only needs to visit the bank’s page on Trustpilot to see how evident this strength is. The majority of the feedback left by customers highlights how the ease of use of the Kroo Bank app is one of the major attributes they love most about it.

How does Kroo Bank compare to Monzo, Revolut, Starling, Chase, and others?

Being a licensed bank in the UK, Kroo Bank is one step ahead of larger fintechs like Revolut, Klarna, and Wise, who do not currently have that cover.

Kroo Bank matches Monzo, Starling, and Chase with zero fees on all foreign purchases. However, it has a 3% charge on all withdrawals over £200 in any month, falling short of Chase’s £1,500 monthly limit and Starling’s £300 daily limit.

A little while ago, Kroo Bank didn’t have pots or spending spaces like Monzo and Starling, but those are active now. It is therefore not too wishful to expect the bank to introduce multi-currency payments like Revolut soon, as its customers cannot make or receive foreign payments yet.

Another drawback is that Kroo Bank isn’t a member of CASS at this time, so there’s no 7-day switching service as of now, although this is likely to be coming soon.

Is Kroo Bank a good choice for you?

As a testament to Kroo Bank’s giant strides, it was voted Most Innovative eCurrency Service at the UK Enterprise Awards (2022) and Best Newcomer at the British Bank Awards (2021).

While this is attractive, the fact simply remains that this bank is not for everyone. There’s a lack of multi-currency accounts and in-person banking opportunities via physical branches. There’s also the fact that it only offers personal accounts at the moment, so businesses can’t use it yet.

In terms of eligibility, there’s an age requirement of 18 years old. Kroo Bank welcomes applications from all nationalities, but applicants must reside at a UK address, whether they are UK tax residents or not. The bank conducts quick UK Credit Reference Agency checks on all applications. These initial checks only leave soft footprints on applicants’ credit files and will not affect their credit scores.

Despite its obvious limitations, Kroo Bank is still one of the most easy-to-use digital banks out there, offering amazing interest rates and free services, while also boasting one of the most laudable social awareness projects among UK banks. If the cons don’t outweigh the pros for you, then it’s definitely a bank worth taking a chance on.

Also, for anyone who is thinking seriously about the earth and its preservation, it would be nice to have trees planted in your name—and at your preferred location—now, wouldn’t it?