Our general review of Marcus By Goldman Sachs in a nutshell

Goldman Sachs is popular for its big-money financial services, but with Marcus by Goldman Sachs, the finance giant introduced a savings account for ordinary customers—one that is digital-only and rewards its customers with higher-than-average rates.

On the pros side, Marcus by Goldman Sachs has no minimum deposit requirements on its savings accounts, and, of course, very competitive rates. It also has a low minimum deposit for CD accounts and doesn’t charge any fees—either for maintenance, service, or transfer.

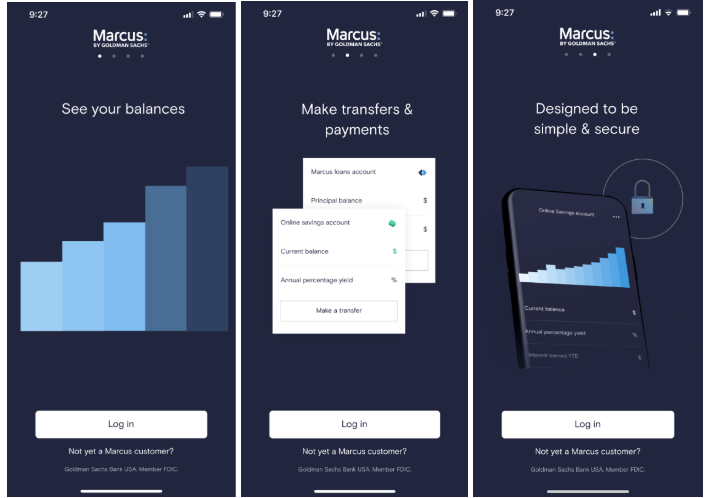

On the cons side, many who are not tech-savvy might struggle as it’s all-in-app with no physical branches or ATM network. The bank provides no checking accounts, IRAs, loans, or credit cards. Also, it has no mobile check deposit facilities.

Who is Marcus by Goldman Sachs?

Since 2016, finance giant, Goldman Sachs Bank has built on the deposit base of GE Capital Bank, which it acquired in the same year. It fused this deposit base with the personal finance management capability and the existing customer base of Clarity Money. With that formidable combination, its consumer banking arm was born in the form of Marcus by Goldman Sachs.

Marcus – named after one-half of Goldman Sachs’ founders—is a new-age, digital bank that provides no-fee high-yield savings accounts, a variety of certificates of deposit, credit cards, and automated investment options.

The bank has no physical branches as it is fully digital. It also does not have an ATM network. Its major mandate is described as assisting its customers to manage their money outside of the investment banking industry.

Marcus is designed to compete with savings accounts offered by high street banks and is majorly targeted at ordinary savers. Typically, anyone can open an account with as little as £1 and as much as £250,000. This flexibility, coupled with its highly competitive interest rates has helped it to hold over $20 billion in savings since being launched in the US. It also helped it to expand to the UK in 2018.

Following the UK expansion, Marcus hit the 100,000 customers milestone in just 40 days, which translates to one new account every 35 seconds.

Only two years later, in June 2020, the bank announced that it was closing its doors to new customers after its deposits exceeded £21 billion, only a few more shy of the Bank of England’s ringfencing mark of £25 billion. By then, it already had amassed over 500,000 users and was inundated with cash deposits by cash-rich households during the 2020 Covid lockdown.

It wasn’t until about eight months after, in February 2021, that Marcus by Goldman Sachs reopened its doors to new customers. The doors have remained open, and since then, Marcus has consistently demonstrated that it plans to dominate the UK personal finance market.

This popularity is, however, not enough reason to open a Marcus by Goldman Sachs account without first taking a close look to determine if the bank is a good fit for you.

In the sections that follow, we will take you through the bank’s nuances, explore what it has on offer, and how it compares to its competition. Then, we will summarise its basic strengths and weaknesses, and how those can help guide you when making a decision.

How safe is Marcus by Goldman Sachs?

Besides being owned by one of the world’s reputable names in finance, Marcus is fully licenced by the Financial Conduct Authority, which means your money is safe. It is also protected by FSCS, which means that the government will fully guarantee any deposits up to £85,000 in the rare event that Goldman Sachs goes bankrupt.

Marcus’ FCSC protection also means that, if as a customer there are any areas of the banks’ services that you feel duly aggrieved on, then you’re free to make a complaint to the Financial Ombudsman.

What benefits come with a Marcus by Goldman Sachs account?

Marcus by Goldman Sachs offers three account types: Online Savings Account, 1 Year Fixed Rate Saver, and Cash ISA.

The Online Savings Account comes with a 4.75% / 4.65% gross (variable) interest rate – AER stands for Annual Equivalent Rate, and it represents what your rate would be if interest were paid and compounded once a year. This account also includes a bonus rate of 0.49% gross fixed for the first 12 months. Unlike the other offerings, this account can be opened as a sole signatory or in joint names.

The 1 Year Fixed Rate Saver comes with a 4.90% AER/gross (fixed) interest rate. It helps you put away your savings while knowing exactly how much you’ll earn as the rate is fixed for 1 year. For this account, there is a 14-day window at the start of the saving period which allows you to add up to £250,000. All of the funds paid in by the 14-day window accrue interest at the same rate of 4.90%.

The Cash ISA comes with a 4.75% AER / 4.65% tax-free (variable) interest rate. Much like the Online Savings Account, this account also includes a bonus rate of 0.49% gross fixed for the first 12 months.

These figures are typically higher than what you’ll find at most other banks. Even better, there is no opening deposit for all three accounts. The required minimum balance is only £1 acrossboard. Also, all interests are calculated daily and paid into your account at the end of each month, except for the 1 Year Fixed Rate Saver which is paid annually.

Unlike many traditional banks’ savings accounts, these Marcus by Goldman Sachs accounts have no monthly maintenance fee—or any other fees. There’s, however, a need to connect an external account as there is no mobile deposit option and cheques can only be deposited through external accounts or by mailing them in. Marcus has no control over external banks and any fees they may charge.

How does Marcus by Goldman Sachs compare to its competition?

Perhaps the most significant of all Marcus’ competition is the JPMorgan-owned Chase Bank. It was launched in 2021, three years after Goldman Sach’s foray into the UK’s personal finance market.

Chase Bank’s approach was different, first introducing current accounts with a 1% cashback on all purchases for a year. Then it followed with linked savings accounts paying 1.5% on savings of up to £250,000 at a time when Marcus was offering between 0.7 and 0.6%. By 2022, Chase Bank had already amassed over one million customers, surpassing Marcus’ 750,000 (at the time) after just one year.

However, in comparison to Marcus by Goldman Sachs’ savings rate of 4.75%, Chase Bank by JPMorgan’s rate is much lower at 4.1%

In a January 2024 publication by Which?, Marcus by Goldman Sachs’ UK operation was awarded a Which? Recommended Providers (WRPs) endorsement for the third year running. In comparison to other savings providers, it received the top customer score of 85 percent as well as five stars for its application process and communication.

Is Marcus by Goldman Sachs a good choice for you?

The Marcus by Goldman Sachs Online Savings Account entices users with high AER, same-day transfers of certain large sums, and an absence of fees. However, for some, the inability to deposit checks remotely may be a deal-breaker.

Also, while electronic transfers to and from the Marcus by Goldman Sachs Online Savings Account are free, there is currently no ATM card available for convenient access to your funds. Some other high-yield online savings accounts have ATM access, so if this is essential to you, you might want to run a comparison check with other savings accounts before making a selection.

Marcus also does not yet provide checking accounts or various other popular financial products (credit cards, auto loans, mortgage loans, etc.) that a regular full-service consumer bank would provide. However, if you can meet your daily banking needs with a different bank, Marcus by Goldman Sachs may be able to help you earn higher interest rates on your savings.

In terms of eligibility, there’s an age requirement of 18 years old. Applicants must be UK residents, including for tax purposes. Accounts can be opened online with the provision of email addresses and phone numbers, so there’s a need for some tech-savviness no matter how basic.

Regardless of the highlighted areas that can be improved on, Marcus by Goldman Sachs provides some of the best AERs currently available for an online savings account with no minimum deposit. This attribute means it can also be a great way to save your emergency money or save for a specific goal, such as a new car, a vacation, or some home repair. And with its attractive rates on consumer deposit products, your funds are definitely in a great place for growth.