GoHenry Review: A Debit Card for Kids that Encourages Financial Health

What Is Gohenry?

Founded in 2012 by a group of parents, GoHenry is a pocket money app for teaching money skills to kids and teens.

They believe that children learn about money by handling it themselves, even if they make mistakes.

At this point, many parents may be thinking: danger!

Don’t worry. With GoHenry, they learn financial responsibility and experience handling money under your watchful eye.

So you can have peace of mind that your child isn’t splurging all their savings on Fortnite or Roblox.

How does GoHenry stack up against other pocket money apps?

Let’s explore in this comprehensive review.

How Does Gohenry Work?

GoHenry works primarily through its app, which is available for both IOS and Android devices.

It provides a demo to get you started and gives you a feel for the layout and features.

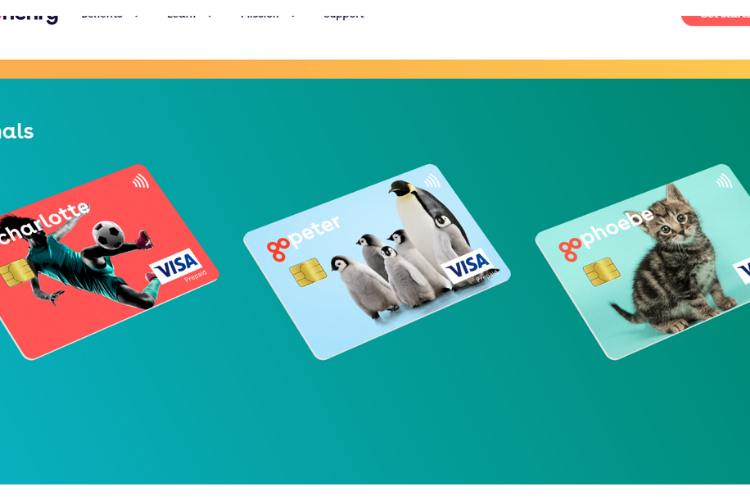

Your child also gets a personalised Visa prepaid card, perfect for shopping or ATM withdrawals.

They can only spend what’s loaded, which means there’s no debt or overdraft risk.

The app allows them to check balances and spending guidelines you’ve set.

It’s a safe, manageable way to teach financial responsibility.

Setting up an account is a straightforward process.

First, you’ll need to register yourself as the parent.

Once that’s done, you simply fill in your child’s details to establish their account.

Here is what you can do on a parent account:

- Set boundaries, allowances, tasks and savings goals

- Receive real-time notifications

- Control where the card can and can’t be used (ATMs etc.)

- Create and manage chores

- Instantly send money to your child’s account

- Block and unblock your child’s card

- Monitor spending and track purchases

Here is what you can do on a child/teenager account:

- Work towards tasks and savings goals

- Complete chores for money

- Budget their pocket money and set savings goals

- Receive real-time notifications for spending

- Send money to charity

- Change themes

Spend, Save, Earn, and Send Money with GoHenry

GoHenry’s smart app offers an interactive platform for teaching children about financial responsibility.

Its features include:

- Money Missions – Educational content for your kids.

- Separate Child and Parent Account – Different interface and set of features on the app depending on whether you are the child or parent.

- Set Up Regular Allowances – Easily set up deposits that contribute to your child’s pocket money.

- Set Task & Goals – Set up tasks or goals your child can work towards.

- Instant Money Transfers – Send money to your child’s account instantly (school trips, etc).

- Easily Block or Unblock Cards – Block and unblock cards at the touch of a button.

- Spending Controls – Set controls on where your little one can spend money.

- Gift Money – Send money to those less fortunate.

It’s a comprehensive and engaging way for kids to foster financial literacy from an early age.

How Much Does Gohenry Cost?

GoHenry is a subscription service that charges a monthly fee of £2.99 per child.

The first load of the parent account each month is free, with subsequent loads costing 50p each.

If you’re worried about these small fees adding up, there’s a simple solution.

Just add your child’s entire monthly allowance to your account in one go.

This way, you can manage the budget effectively and avoid any extra charges.

GoHenry also offers customised debit cards for £5.00, but you can just as easily get the standard card for free.

(Note: If you use this link, you can get a free custom card and 1 month free when you enter the code AFUKFNACC)

Here are some great examples of custom card designs.

Limits

GoHenry has a series of restrictions when it comes to using their card.

Here is a look at them below.

| Limits | GDP |

|---|---|

| Maximum Parent Account Balance | £6,000 |

| Annual Parent Load Limit | £10,000 |

| Account Load | £2-£500 |

| Child ATM Withdrawals | £5-£120 |

| Maximum Child ATM Withdrawals In A Day | 3 |

| Maximum Child Spends A Day | 10 |

| Maximum Child Account Spend In A Day | £4,000 |

You can find a more granular look at Gohenry’s restrictions here.

Is Gohenry Safe?

The Financial Services Compensation Scheme (FSCS) does not protect GoHenry as it’s not considered a bank and, therefore, does not satisfy the criteria for protection.

However, as a partner of Visa, GoHenry must adhere to the regulations they impose.

The funds you deposit with GoHenry are held in a segregated account, meaning GoHenry can’t access it.

So if, for any reason, GoHenry or its partner IDT face financial difficulties, your money will be paid back in full.

It’s also worth noting that their app and website use bank-grade encryption courtesy of their payment processing partner.

Gohenry Reviews

According to Trustpilot, GoHenry has an overall score of 3.8 out of 5.

With over 4,500 reviews, the company is rated as ‘great’.

68% of the reviews gave them 5 stars, while 13% rated them at 1 star.

Positive GoHenry reviews include feedback like:

- My kids enjoy this app

- Fantastic idea

- Works well

- Gives my child more independence

Negative GoHenry reviews touch on things like:

- Issues with customer service response times

- 50p top-up and transfer fees

GoHenry’s Competitors

When it comes to pocket money apps, there is some good competition out there.

So next up in this Gohenry review is a comparison of them and their current competitors.

Roostermoney vs GoHenry

Rooster is similar to GoHenry in that it offers educational content and a bunch of features to help your child develop good money habits.

Both apps allow parents to set chores, tasks, and goals as well as implement blocking features for their child’s card.

The main difference is that Roostermoney has developed 3 plans that cater to those as young as 3.

By comparison, GoHenry only has 1 standard child/teenage account for those 6+.

Here is a brief look at the 3 plans:

| Virtual Planner | Roosterplus | Roostercard | |

|---|---|---|---|

| Cost | Free | £14.99/year or £1.99/monthly (1 Month Free Trial) | * £24.99/year (1 Month Free Trial) |

| Ages | 3+ | 5+ | 6+ |

| Set Goals | ✔️ | ✔️ | ✔️ |

| Chore management System | ❌ | ✔️ | ✔️ |

| Prepaid Card | ❌ | ❌ | ✔️ |

*Can only be paid annually

As you can see from the chart above, Roostermoney can also technically be used for free if you stick to the virtual tracker plan.

In addition, this plan uses virtual currency or stars, not real money.

Hyperjar vs GoHenry

Hyperjar, recommended by Martin Lewis of MoneySavingExpert, is also a prepaid debit card for kids.

But it utilises pots to help kids manage money.

Its main appeal is the fact that it’s completely free to use, unlike other pocket money apps on the market.

Just like its competitors, Hyperjar has a dedicated child’s app (6+) that can be accessed after you create an account as a parent.

The kid’s app has a range of features like saving jars and educational content, while parents can implement spending and blocking controls on their version.

The biggest downside of Hyperjar is that you can’t use the card to withdraw money from ATMs or currency exchange services.

Nimbl vs GoHenry

Nimbl, much like GoHenry, is targeted at parents with kids between the ages of 6 to 18.

Both parents and kids have their own version of the app, which includes interesting features like:

- Instant top-ups

- Micro savings

- Spending alerts

- Spending controls

- Nimbl is marginally cheaper than GoHenry at £2.49/month and offers a 1-month free trial.

What makes GoHenry stand out is the fact it’s free to use abroad, while Nimbl charges a 2.95% exchange rate fee on all foreign transactions.

Frequently Asked Questions

Can GoHenry Be Used Abroad?

Yes, GoHenry can be used anywhere where Visa is accepted at no extra cost.

However, be wary of foreign ATMs that charge small fees.

How Much is GoHenry per month?

£2.99/month per child.

Is GoHenry Worth It?

GoHenry is a great choice if you’re searching for an app to help your child nurture positive financial habits.

It teaches them how to spend wisely, save diligently, and understand the value of every penny.

What Companies Are Similar To GoHenry?

Roostermoney

Nimbl

Hyperjar

Is There A Free Version Of GoHenry?

Unfortunately not.

However, GoHenry does offer a 1 month free trial period that you can use to establish whether or not you think it’s worth it.

What Does GoHenry Do?

GoHenry offers children a chance to learn about finances by giving them a card they can use for themselves – all under their parents’ watchful eye.

Is Gohenry a sustainable choice?

GoHenry’s new eco-friendly card is biodegradable, making it the preferred choice of 76% of UK kids.

The card, made from compostable polylactic acid (derived from field corn waste), uses less energy and produces fewer greenhouse gases than traditional plastic.

The green Eco Card, made from 82% bio-sourced renewable material, is another option.

Plus, with every first use of a card, GoHenry partners with Eden Reforestation Projects to plant a tree.

Final Thoughts on this GoHenry Review

We hope our review has provided some clarity on whether GoHenry aligns with your family’s needs and expectations.

It undoubtedly has excellent educational value and tools for both parents and kids.

Plus, if your family loves jet-setting adventures, the GoHenry card stands out as the top pick for overseas use.

It’s a handy companion for those who frequent family trips abroad.

However, after looking at GoHenry against its competitors, they don’t fare as well as you’d expect for arguably the biggest pocket money app in the UK.

The monthly fee is higher than all other similar apps we looked at, and that’s not taking into account the 50p top-up fee you can incur for additional loading each month.

As we saw from the GoHenry reviews on Trustpilot earlier, this was also one of the main reasons for 1-star reviews.

Ultimately, there’s no one-size-fits-all answer here.

The best choice always depends on your specific situation and your family’s requirements.

To help you make an informed choice, we would at least consider trying out GoHenry’s competitors first – especially considering they all offer a 1-month free trial.